Refrigerant Market Outlook

The global refrigerant market is undergoing a transformative shift, driven by growing environmental concerns, the enforcement of stricter regulations, and surging demand for advanced cooling technologies. As the world transitions toward sustainable alternatives, the market is witnessing rapid innovation in low-global warming potential (GWP) refrigerants and natural cooling agents, setting the stage for robust growth over the coming decade.

Market Overview

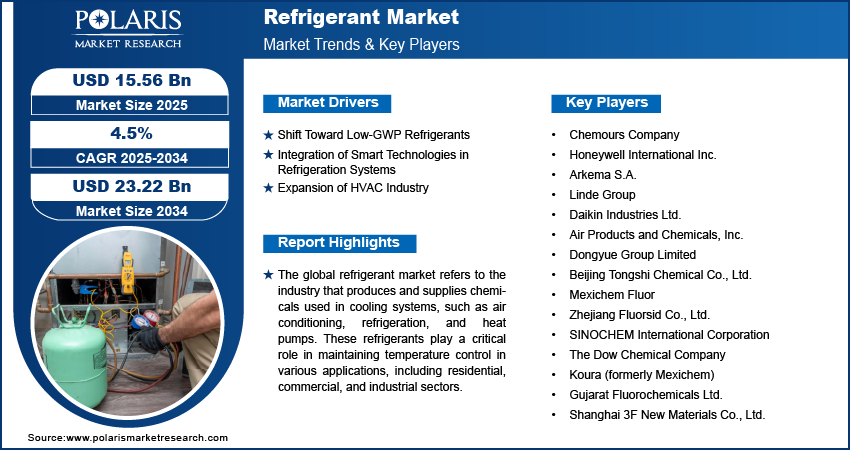

Refrigerants are substances used in heat pump and refrigeration cycles for cooling agents in air conditioning, refrigeration, and heating systems. They are essential to the functioning of residential, commercial, and industrial HVAC systems and cold chain logistics. Traditional refrigerants, such as chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs), have been phased out due to their harmful impact on the ozone layer and global warming. The global refrigerant market size was valued at USD 14.90 billion in 2024. The market is projected to grow from USD 15.56 billion in 2025 to USD 23.22 billion by 2034, exhibiting a CAGR of 4.5% during 2025–2034.

As industries and governments pivot to climate-friendly practices, there is a marked shift toward environmentally friendly refrigerants. Hydrofluorocarbons (HFCs) are being replaced with hydrofluoroolefins (HFOs), carbon dioxide (CO₂), ammonia (NH₃), and hydrocarbons like propane (R-290). The growing adoption of such sustainable alternatives is reshaping the refrigerant market landscape.

The demand for energy-efficient cooling solutions is further bolstered by rapid urbanization, expanding middle-class populations in emerging economies, and increased usage of air conditioners and commercial refrigeration units.

Report Scope

Refrigerant Market, Type Outlook (Revenue – USD Billion, 2020-2034)

- Fluorocarbons

- Hydrocarbons

- Inorganic Refrigerants

Refrigerant Market, Applications Outlook (Revenue – USD Billion, 2020-2034)

- Air Conditioning

- Refrigeration

- Others

Refrigerant Market, End User Outlook (Revenue – USD Billion, 2020-2034)

- Industrial

- Commercial

- Domestic

Browse Full Insights:https://www.polarismarketresearch.com/industry-analysis/refrigerant-market

Regional Analysis

North America

North America, led by the U.S. and Canada, holds a major market share owing to established HVAC infrastructure and regulatory mandates on HFC phase-downs. The Environmental Protection Agency (EPA) is aggressively pushing for low-GWP refrigerants and has implemented SNAP (Significant New Alternatives Policy) programs to accelerate adoption. Commercial and automotive sectors are the key demand drivers in this region.

Europe

Europe remains at the forefront of sustainable refrigerant adoption, guided by the F-Gas Regulation that restricts the use of high-GWP substances. Countries like Germany, France, and the UK have embraced environmentally friendly refrigerants such as CO₂ and HFO blends. The European Union’s Green Deal and push for carbon neutrality are amplifying investments in natural refrigerants and eco-label-certified systems.

Asia-Pacific

The Asia-Pacific region is witnessing the fastest growth, driven by rising urbanization, hot climates, and booming residential construction. China, India, Japan, and South Korea are leading markets. As the largest global producer of refrigerants, China plays a pivotal role in shaping global supply chains. Government policies supporting energy-efficient air conditioning units and refrigerant transitions are catalyzing market evolution.

Latin America and Middle East & Africa

These regions are in the early phases of adopting sustainable refrigerant solutions. Growth is expected as infrastructure expands, consumer awareness increases, and international agreements (like the Kigali Amendment) are ratified and enforced. Brazil, UAE, and South Africa show strong potential in industrial and commercial refrigeration adoption.

Key Companies in the Refrigerant Market

- Honeywell International Inc.

A global leader in the production of next-generation refrigerants like Solstice® (HFO series), Honeywell has pioneered R-1234yf adoption in automotive and building sectors. - The Chemours Company

Known for its Opteon™ product line, Chemours is a key player in the shift toward sustainable HFO refrigerants across multiple industries, including mobile AC and commercial refrigeration. - Arkema S.A.

Headquartered in France, Arkema produces Forane® refrigerants and is heavily investing in lower-GWP solutions, especially for European markets. - Daikin Industries Ltd.

A major HVAC equipment manufacturer, Daikin also produces refrigerants and promotes the use of R-32, a low-GWP alternative, in residential and commercial air conditioning systems. - Dongyue Group

One of China’s largest refrigerant manufacturers, Dongyue is focusing on expanding its HFO and fluoropolymer portfolios in response to global climate policies. - SRF Limited

An Indian chemical giant, SRF plays a major role in supplying fluorochemicals and is actively participating in the global transition to climate-friendly refrigerants.

Market Trends and Future Outlook

- HFC Phase-Down and Kigali Amendment Compliance: Global efforts to phase down HFCs are accelerating investment in next-gen refrigerants, especially in developing nations.

- Green Building Certifications: Adoption of LEED and BREEAM standards is promoting systems that utilize low-GWP refrigerants.

- Cold Chain Expansion: Growth in e-commerce, pharmaceuticals, and food delivery is increasing demand for industrial refrigeration, especially in emerging economies.

- Innovation in Refrigerant Blends: New HFO-HFC blends are being designed to balance performance and regulatory compliance while offering backward compatibility with existing systems.

- Circular Economy and Refrigerant Reclamation: Recycling and reclaiming old refrigerants for reuse is gaining traction as industries seek to reduce environmental impact and costs.

Recent Developments in the Refrigerant Industry

- May 2024: Chemours entered into a strategic partnership with a leading European company to supply low-GWP refrigerants for commercial refrigeration systems. This collaboration supports the industry’s shift toward eco-friendly solutions and reflects Chemours’ commitment to expanding its product offerings in compliance with evolving environmental regulations.

- April 2024: Honeywell launched a new range of low-GWP refrigerants specifically designed for the automotive industry. These refrigerants aim to enhance the energy efficiency and environmental performance of vehicle air conditioning systems, reinforcing Honeywell’s dedication to developing sustainable, regulation-compliant solutions.

Would you like this adapted for a full press release section?

Conclusion

The global refrigerant market is evolving swiftly, shaped by stringent environmental regulations, technological innovation, and a collective push toward sustainable climate solutions. As manufacturers invest in cooling agents that are efficient and eco-conscious, end-users across industries—from residential and automotive to cold chains—are shifting to low-global warming potential refrigerants.

The industry’s future lies in harmonizing environmental stewardship with performance and cost-effectiveness. Players that prioritize innovation, regulatory compliance, and market education will be best positioned to lead the global refrigerant transformation.

More Trending Latest Reports By Polaris Market Research:

Retail Point-Of-Sale (Pos) Terminals Market

Rheumatoid Arthritis (Ra) Market

Xerostomia Therapeutics Market