In an age where road safety and vehicle automation are increasingly prioritized, Automotive Blind Spot Detection Systems (BSD) have emerged as a crucial technology in the automotive industry. These systems use sensors, radar, and cameras to detect vehicles or obstacles in the driver’s blind spots—areas not visible through mirrors—thereby reducing collision risks during lane changes or merging.

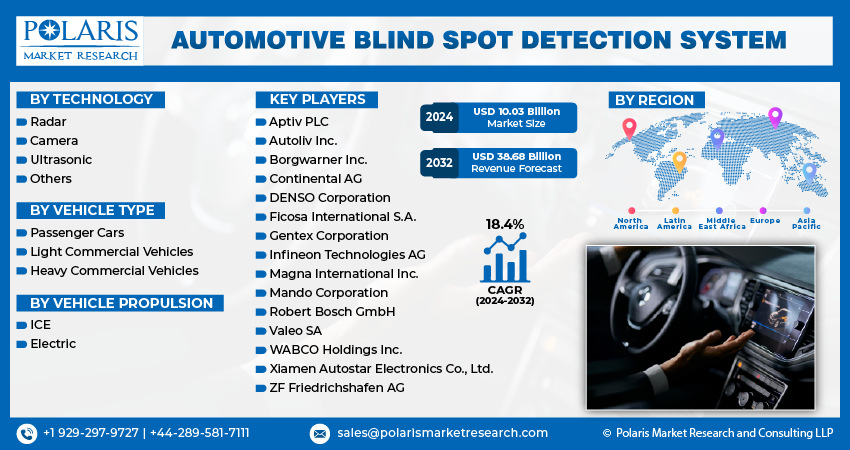

According to Polaris Market Research, the global Automotive Blind Spot Detection System Market was valued at USD 8.48 billion in 2023. It is projected to reach USD 38.68 billion by 2032, growing at a Compound Annual Growth Rate (CAGR) of 18.4% from 2024 to 2032. This remarkable growth underscores the increasing integration of advanced driver-assistance systems (ADAS) and the heightened consumer awareness surrounding vehicular safety.

Some of the major players operating in the global market include:

- Aptiv PLC

- Autoliv Inc.

- Borgwarner Inc.

- Continental AG

- DENSO Corporation

- Ficosa International S.A.

- Gentex Corporation

- Infineon Technologies AG

- Magna International Inc.

- Mando Corporation

- Robert Bosch GmbH

Market Growth Drivers

Several powerful factors are fueling the robust growth of the BSD market:

- Rising Vehicle Safety Regulations

Governments across the globe are tightening safety regulations and mandating the inclusion of ADAS technologies, including BSD systems, in vehicles. For instance, the European Union and the United States have enacted legislation requiring specific safety features in new vehicles to reduce road accidents.

- Increasing Demand for Luxury and High-End Vehicles

Luxury and premium vehicle manufacturers have been early adopters of BSD technology. As consumer purchasing power rises—especially in emerging economies—so does the demand for vehicles equipped with safety and comfort features. This, in turn, drives up the need for BSD systems.

- Advancements in Sensor and Radar Technologies

Ongoing advancements in sensor fusion, radar detection, and real-time image processing have significantly improved the accuracy and reliability of BSD systems. These improvements enhance the user experience and bolster consumer trust in these technologies.

- Growth of Electric and Autonomous Vehicles

With the global shift towards electric and autonomous vehicles, automakers are embedding more ADAS features as standard offerings. BSD systems play a critical role in autonomous driving technologies, helping vehicles make intelligent lane-changing decisions without human intervention.

- Consumer Awareness and Safety Concerns

Heightened awareness among consumers regarding road safety and accident prevention has led to increased adoption of BSD systems even in mid-range vehicles. Many automakers are responding by offering these systems either as standard or optional equipment.

Key Market Trends

The BSD market is evolving in tandem with broader trends in automotive safety and intelligent transportation:

- Integration with Other ADAS Features

Blind spot detection systems are increasingly being integrated with other safety technologies such as lane departure warning, adaptive cruise control, and rear cross-traffic alert systems, offering a comprehensive safety suite.

- Adoption in Two-Wheelers and Commercial Vehicles

While historically prevalent in passenger cars, BSD systems are now making their way into two-wheelers and commercial vehicles such as trucks and buses. This is especially important in urban areas where maneuverability and visibility are limited.

- Use of Artificial Intelligence (AI) and Machine Learning (ML)

Manufacturers are incorporating AI and ML algorithms to improve object detection accuracy and reduce false alarms. These intelligent systems can differentiate between various objects and predict their movement to make smarter driving decisions.

- Growing Aftermarket Sales

With the retrofitting of safety systems gaining popularity, the aftermarket segment for BSD systems is expanding. Vehicle owners are increasingly installing BSD units in older models to enhance safety without purchasing a new car.

- Strategic Collaborations and Product Launches

Automotive OEMs and technology providers are collaborating to develop next-generation BSD solutions. Strategic alliances, mergers, and partnerships are contributing to product innovations and global market penetration.

Research Scope

The latest market research explores various facets of the BSD ecosystem, offering insights into:

- Historical and current market size and forecast from 2020 to 2032.

- Regional performance, highlighting key growth territories like North America, Europe, and Asia-Pacific.

- Technological landscape, including sensor types (radar, ultrasonic, camera-based).

- Consumer behavior, installation rates, and adoption trends by vehicle class.

- Competitive landscape, profiling major players such as Continental AG, Bosch, Denso Corporation, Valeo, and Aptiv.

This comprehensive analysis provides decision-makers with actionable intelligence to strategize product offerings, regional expansions, and partnerships.

Market Segmentation

Global Automotive Blind Spot Detection System Market, by Technology

5.1. Key Findings

5.2. Introduction

5.2.1. Global Automotive Blind Spot Detection System Market, by Technology, 2019-2032 (USD Billion)

5.3. Radar

5.3.1. Global Automotive Blind Spot Detection System Market, by Radar, by Region, 2019-2032 (USD Billion)

5.4. Camera

5.4.1. Global Automotive Blind Spot Detection System Market, by Camera, by Region, 2019-2032 (USD Billion)

5.5. Ultrasonic

5.5.1. Global Automotive Blind Spot Detection System Market, by Ultrasonic, by Region, 2019-2032 (USD Billion)

5.6. Others

5.6.1. Global Automotive Blind Spot Detection System Market, by Others, by Region, 2019-2032 (USD Billion)

Global Automotive Blind Spot Detection System Market, by Vehicle Type

6.1. Key Findings

6.2. Introduction

6.2.1. Global Automotive Blind Spot Detection System Market, by Vehicle Type, 2019-2032 (USD Billion)

6.3. Passenger Cars

6.3.1. Global Automotive Blind Spot Detection System Market, by Passenger Cars, by Region, 2019-2032 (USD Billion)

6.4. Light Commercial Vehicles

6.4.1. Global Automotive Blind Spot Detection System Market, by Light Commercial Vehicles, by Region, 2019-2032 (USD Billion)

6.5. Heavy Commercial Vehicles

6.5.1. Global Automotive Blind Spot Detection System Market, by Heavy Commercial Vehicles, by Region, 2019-2032 (USD Billion)

Global Automotive Blind Spot Detection System Market, by Vehicle Propulsion

7.1. Key Findings

7.2. Introduction

7.2.1. Global Automotive Blind Spot Detection System Market, by Vehicle Propulsion, 2019-2032 (USD Billion)

7.3. ICE

7.3.1. Global Automotive Blind Spot Detection System Market, by ICE, By Region, 2019-2032 (USD Billion)

7.4. Electric

7.4.1. Global Automotive Blind Spot Detection System Market, by Electric, By Region, 2019-2032 (USD Billion)

By Region

- North America: A mature market with high penetration of ADAS technologies.

- Europe: Strong regulatory framework and emphasis on vehicle safety.

- Asia-Pacific: Fastest-growing region due to expanding automotive industry in China, India, and Japan.

- Latin America & MEA: Gradually adopting BSD systems amid increasing urbanization and vehicle ownership.

Explore The Complete Comprehensive Report Here:

Recent Developments

In November 2023, Honda Motor Co., Ltd. introduced Honda SENSING 360+, an advanced safety and driver-assistance system designed to eliminate blind spots, improve collision avoidance, and reduce driver fatigue during travel.

In January 2022, Texas Instruments expanded its automotive solutions with the launch of the AWR2944 radar sensor. This cutting-edge technology enhances the sensing capabilities of advanced driver-assistance systems (ADAS), enabling faster object detection and improved blind spot monitoring—key advancements that contribute to higher safety standards in modern vehicles.

Conclusion

The Automotive Blind Spot Detection System Market is on a high-growth trajectory, driven by regulatory mandates, technological advancements, and growing consumer awareness around road safety. As vehicles become smarter and more autonomous, BSD systems will play an increasingly integral role in ensuring safe mobility.

With strong support from OEMs, rising global vehicle production, and technological innovation, the market is poised for substantial expansion through 2032. Stakeholders who invest in research, strategic partnerships, and consumer education will be well-positioned to capitalize on this accelerating trend.

More Trending Latest Reports By Polaris Market Research:

Functional Endoscopic Sinus Surgery Market

Clindamycin Phosphate Injection Market

Cellular Starting Materials Market