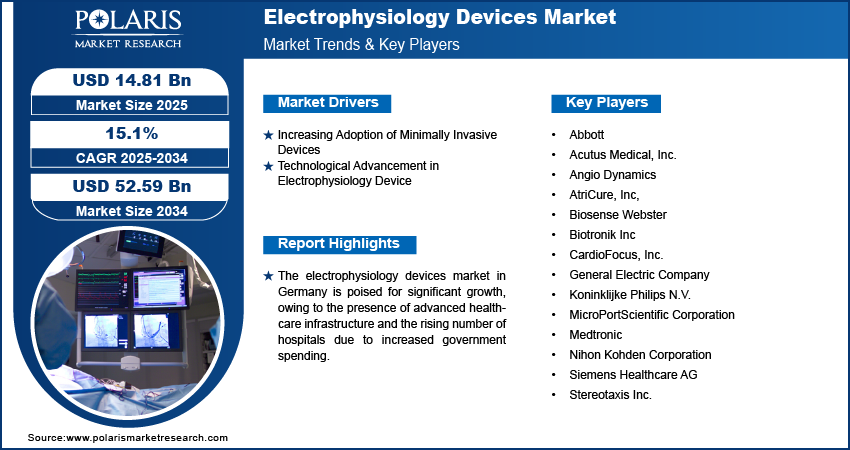

The global electrophysiology (EP) devices market is experiencing remarkable growth, driven by the rising prevalence of cardiac arrhythmias, technological innovation in cardiac care, and increasing awareness about early diagnosis. Valued at USD 12.88 billion in 2024, the market is projected to surge to USD 52.59 billion by 2034, reflecting a robust Compound Annual Growth Rate (CAGR) of 15.1% from 2025 to 2034, as reported by Polaris Market Research.

Electrophysiology devices are used to diagnose and treat irregular heart rhythms by mapping the electrical activity within the heart and delivering therapeutic interventions. These devices encompass ablation catheters, diagnostic catheters, 3D mapping systems, and more. As cardiovascular diseases continue to be the leading cause of death globally, electrophysiology solutions offer clinicians minimally invasive, precise, and effective tools for managing heart rhythm disorders, such as atrial fibrillation and ventricular tachycardia.

Competitive Landscape

- Abbott

- Acutus Medical, Inc.

- Angio Dynamics

- AtriCure, Inc,

- Biosense Webster (Johnson & Johnson Services, Inc.)

- Biotronik Inc

- CardioFocus, Inc.

- General Electric Company

- Koninklijke Philips N.V.

- MicroPortScientific Corporation

- Medtronic

- Nihon Kohden Corporation

Market Growth Drivers

Several powerful forces are propelling the growth of the global electrophysiology devices market:

- Rising Incidence of Cardiac Arrhythmias

A major driver of the market is the increasing prevalence of arrhythmias, particularly atrial fibrillation (AFib), which affects over 37 million people worldwide. With aging populations and lifestyle-related risk factors such as hypertension, obesity, and diabetes on the rise, the need for advanced diagnostic and treatment solutions is growing rapidly.

- Technological Innovations in EP Devices

Recent years have seen the development of next-generation EP technologies, including contact force-sensing catheters, 3D electroanatomical mapping systems, and cryoablation tools. These innovations offer enhanced precision, safety, and patient outcomes, encouraging their adoption by cardiologists and electrophysiologists.

- Increasing Adoption of Minimally Invasive Procedures

There is a growing preference for minimally invasive cardiac interventions over traditional open-heart surgeries, owing to quicker recovery times, reduced hospital stays, and lower complication risks. Electrophysiology procedures, typically performed via catheterization, are well-suited to meet this demand.

- Expansion of Healthcare Infrastructure in Emerging Markets

Countries in Asia-Pacific, Latin America, and the Middle East are expanding their healthcare systems, improving access to advanced cardiovascular diagnostics and therapies. As awareness about arrhythmia management increases, so does the uptake of EP devices in these regions.

- Supportive Government Initiatives and Reimbursement Policies

Increased funding for cardiac research and favorable reimbursement structures in developed countries have facilitated broader access to electrophysiology procedures. These policy measures enhance the affordability and accessibility of EP treatments.

Key Trends Reshaping the Electrophysiology Devices Market

- Integration of Artificial Intelligence (AI) and Robotics

AI-powered diagnostic platforms and robotic-assisted electrophysiology procedures are transforming cardiac care by enhancing mapping accuracy, shortening procedure times, and reducing human error. Companies are investing heavily in integrating AI into EP workflows for better clinical decision-making.

- Shift Toward Outpatient and Ambulatory Settings

As procedural techniques improve and safety increases, EP procedures are increasingly being performed in outpatient or ambulatory surgical centers (ASCs). This shift reduces healthcare costs while maintaining high-quality outcomes and is a trend likely to accelerate in the coming years.

- Advancements in Mapping and Imaging Systems

The demand for high-resolution 3D electroanatomical mapping systems is on the rise as clinicians seek more detailed visualizations of arrhythmic areas. These systems help plan and guide ablations with greater accuracy, improving patient safety and treatment success.

- Growing Popularity of Cryoablation and Pulsed Field Ablation (PFA)

Cryoablation, which uses cold energy to target cardiac tissue, and PFA, a newer energy modality, are gaining momentum as alternatives to traditional radiofrequency ablation. Both techniques promise lower complication rates and improved procedural consistency.

- Increasing Investment and M&A Activity

The market is witnessing a wave of investments, collaborations, and mergers & acquisitions as major players seek to expand their product portfolios and global reach. Strategic partnerships are also being formed to develop integrated EP solutions that combine hardware, software, and data analytics.

Research Scope

The research into the electrophysiology devices market covers:

- Market size, share, and forecast (2024–2034)

- Product innovation and clinical adoption trends

- Analysis of competitive landscape and market positioning

- Regional dynamics and growth potential

- Regulatory considerations and approval pathways

- Healthcare infrastructure and reimbursement scenario across key regions

This research provides critical insights for manufacturers, investors, and healthcare providers looking to navigate the evolving EP landscape.

Market Segmentation

Global Electrophysiology Device Market, by Indication

5.1. Key Findings

5.2. Introduction

5.2.1. Global Electrophysiology Device Market, by Indication, 2020-2034 (USD Billion)

5.3. Atrial Fibrillation (AF)

5.3.1. Global Electrophysiology Device Market, by Atrial Fibrillation (AF), by Region, 2020-2034 (USD Billion)

5.4. Supraventricular Tachycardia

5.4.1. Global Electrophysiology Device Market, by Supraventricular Tachycardia, by Region, 2020-2034 (USD Billion)

5.5. Atrioventricular Nodal Re-entry Tachycardia (AVNRT)

5.5.1. Global Electrophysiology Device Market, by Atrioventricular Nodal Re-entry Tachycardia (AVNRT), by Region, 2020-2034 (USD Billion)

5.6. Wolff-Parkinson-White Syndrome (WPW)

5.6.1. Global Electrophysiology Device Market, by Wolff-Parkinson-White Syndrome (WPW), by Region, 2020-2034 (USD Billion)

5.7. Bradycardia

5.7.1. Global Electrophysiology Device Market, by Bradycardia, by Region, 2020-2034 (USD Billion)

5.8. Other

5.8.1. Global Electrophysiology Device Market, by Other, by Region, 2020-2034 (USD Billion)

Global Electrophysiology Device Market, by Application

6.1. Key Findings

6.2. Introduction

6.2.1. Global Electrophysiology Device Market, by Application, 2020-2034 (USD Billion)

6.3. Treatment Device

6.3.1. Global Electrophysiology Device Market, by Treatment Device, by Region, 2020-2034 (USD Billion)

6.3.2. Implantable Cardioverter Defibrillators (ICDs)

6.3.2.1. Global Electrophysiology Device Market, by Implantable Cardioverter Defibrillators (ICDs), by Region, 2020-2034 (USD Billion)

6.3.3. Automated External defibrillators (AEDs)

6.3.3.1. Global Electrophysiology Device Market, by Automated External defibrillators (AEDs), by Region, 2020-2034 (USD Billion)

6.3.4. Pacemakers CRT-P

6.3.4.1. Global Electrophysiology Device Market, by Pacemakers CRT-P, by Region, 2020-2034 (USD Billion)

6.3.5. CRT-D

6.3.5.1. Global Electrophysiology Device Market, by CRT-D, by Region, 2020-2034 (USD Billion)

6.3.6. Catheters

6.3.6.1. Global Electrophysiology Device Market, by Catheters, by Region, 2020-2034 (USD Billion)

6.3.7. Others

6.3.7.1. Global Electrophysiology Device Market, Others, by Region, 2020-2034 (USD Billion)

6.4. Diagnostics Device

6.4.1. Global Electrophysiology Device Market, by Diagnostics Device, by Region, 2020-2034 (USD Billion)

6.4.2. Holter Monitoring Devices

6.4.2.1. Global Electrophysiology Device Market, by Holter Monitoring Devices, by Region, 2020-2034 (USD Billion)

6.4.3. Diagnostic Electrophysiology Catheters

6.4.3.1. Global Electrophysiology Device Market, by Diagnostic Electrophysiology Catheters, by Region, 2020-2034 (USD Billion)

6.4.4. Electrocardiograph (ECG)

6.4.4.1. Global Electrophysiology Device Market, by Electrocardiograph (ECG), by Region, 2020-2034 (USD Billion)

6.4.5. EP Mapping & Imaging Systems

6.4.5.1. Global Electrophysiology Device Market, by EP Mapping & Imaging Systems, by Region, 2020-2034 (USD Billion)

6.4.6. Insertable Cardiac Monitors (ICM)

6.4.6.1. Global Electrophysiology Device Market, by Insertable Cardiac Monitors (ICM), by Region, 2020-2034 (USD Billion)

Global Electrophysiology Device Market, by End User

7.1. Key Findings

7.2. Introduction

7.2.1. Global Electrophysiology Device Market, by End User, 2020-2034 (USD Billion)

7.3. Hospitals

7.3.1. Global Electrophysiology Device Market, by Hospitals, by Region, 2020-2034 (USD Billion)

7.4. Ambulatory Surgery Centers

7.4.1. Global Electrophysiology Device Market, by Ambulatory Surgery Centers, by Region, 2020-2034 (USD Billion)

7.5. Others

7.5.1. Global Electrophysiology Device Market, by Others, by Region, 2020-2034 (USD Billion)

By Region:

- North America

- Strongest regional market due to early adoption and reimbursement support.

- Europe

- High demand for innovation and minimally invasive care.

- Asia-Pacific

- Fastest-growing region, driven by improving healthcare access.

- Latin America

- Middle East & Africa

Asia-Pacific is particularly promising, with countries like China, India, and Japan investing heavily in cardiac care capabilities.

Explore The Complete Comprehensive Report Here:

https://www.polarismarketresearch.com/industry-analysis/electrophysiology-devices-market

Electrophysiology Devices Market Developments

In January 2024, GE HealthCare launched the Prucka 3 with CardioLab EP Recording system, designed to enhance arrhythmia diagnostics through advanced signal clarity, real-time displays, and workflow-boosting features. It supports emerging EP technologies and complements GE’s broader cardiology solutions like Allia IGS Pulse and CardioVisio for AFib.

In February 2023, Abbott received CE mark approval in Europe for its TactiFlex Ablation Catheter, Sensor Enabled, which improves atrial fibrillation treatment with flexible tip design and contact force sensing. Used with the Ensite X EP System, it enables more efficient high-power ablation with reduced procedure time and radiation exposure.

In June 2022, Acutus Medical commercially launched its AcQCross Qx system in the U.S., offering improved safety and efficiency for left-heart procedures. Compatible with Watchman LAAC devices and major sheaths, it integrates a needle and dilator to streamline transseptal access.

Conclusion

The global electrophysiology devices market is in the midst of a transformative growth phase, fueled by rising cardiovascular disease burdens, clinical and technological advancements, and a clear preference for minimally invasive, patient-centered care. With a projected market value of USD 52.59 billion by 2034, and a CAGR of 15.1%, the industry is poised to deliver exceptional growth and innovation in the years ahead.

For stakeholders, the key lies in leveraging emerging technologies, addressing unmet clinical needs, and expanding access to EP solutions in high-growth regions. As electrophysiology continues to shape the future of cardiology, companies that prioritize precision, efficiency, and patient outcomes will lead the way.

More Trending Latest Reports By Polaris Market Research:

Erectile Dysfunction Drugs Market

Durable Medical Equipment Market