Market Overview

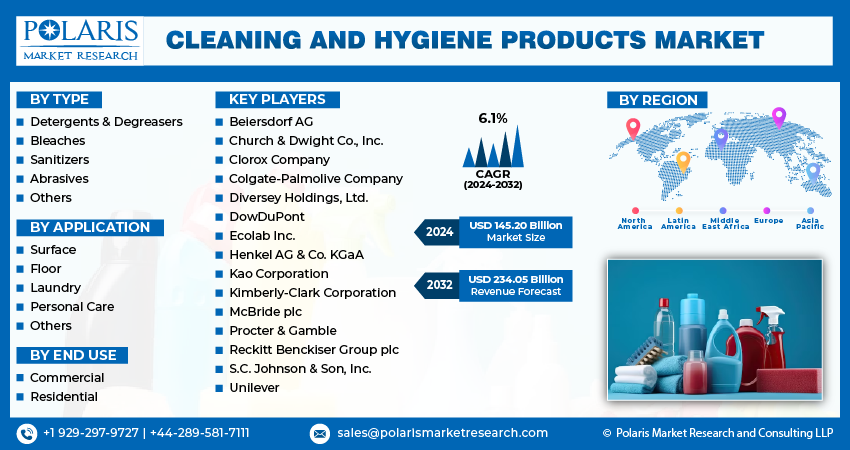

Global Cleaning and Hygiene Products Market size and share is currently valued at USD 145.20 billion in 2024 and is anticipated to generate an estimated revenue of USD 234.05 billion by 2032, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 6.1% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2024 – 2032

The Cleaning and Hygiene Products Market is comprised of consumer and professional-grade products designed to ensure cleanliness, disinfection, and disease prevention. These products play a critical role across residential, healthcare, hospitality, education, and industrial sectors.

Technology is also reshaping this market, with automatic dispensers, smart sanitation systems, and sensor-driven cleaners increasingly being adopted by commercial establishments.

Key Market Growth Drivers

- Increased Focus on Infection Prevention Post-Pandemic

COVID-19 forever transformed public perception of hygiene and disease transmission. Regular use of surface disinfectants, hand hygiene routines, and air purification systems became normalized. This behavioral shift continues to influence product demand, particularly in public spaces, offices, schools, and healthcare settings.

- Rising Demand for Personal Hygiene Products

Growing awareness of personal health, skin safety, and antimicrobial protection has bolstered the demand for personal hygiene products such as hand soaps, sanitizers, wet wipes, and feminine hygiene products. Additionally, product innovation in terms of skin-friendliness, scent options, and compact packaging is expanding market adoption.

- Stringent Health and Safety Regulations

Government and institutional mandates on cleanliness and infection control have intensified across the globe. Regulatory frameworks in hospitals, food manufacturing, hospitality, and pharmaceuticals require regular sanitization protocols with approved chemical formulations. This is fueling investments in compliant infection control solutions.

- Corporate Wellness and Facility Maintenance

Employers across sectors now consider hygiene infrastructure as part of employee well-being initiatives. Office buildings, transportation hubs, and entertainment venues are equipping themselves with touchless dispensers, automated floor cleaners, and air purification systems, increasing the need for professional-grade sanitation supplies.

- Growth of E-Commerce and D2C Hygiene Brands

Digital platforms have democratized access to cleaning and hygiene essentials. Direct-to-consumer models and e-commerce platforms allow brands to reach remote and emerging markets. The convenience of online subscriptions for cleaning products is also driving steady repeat purchases.

- Green and Sustainable Product Innovation

Environmental concerns are influencing consumer choices. Brands offering biodegradable wipes, plant-based detergents, and refillable packaging solutions are gaining traction. Many consumers now seek certifications such as EPA Safer Choice, EcoLabel, or USDA BioPreferred, reflecting a broader shift toward sustainability.

Browse Full Insights:

https://www.polarismarketresearch.com/industry-analysis/cleaning-and-hygiene-products-market

Market Challenges

Despite strong momentum, the cleaning and hygiene products market faces notable challenges:

- Price Sensitivity and Margin Pressures

With intense competition and commoditization of basic cleaning products, many brands face pressure to maintain price competitiveness. Fluctuating raw material prices for ethanol, surfactants, and packaging components further impact profit margins.

- Product Efficacy and Safety Concerns

Consumers are increasingly aware of the health impact of harsh chemicals. Reports linking certain ingredients to skin irritation or respiratory distress can damage brand reputation. Balancing antimicrobial strength with skin-friendliness and environmental safety remains a challenge.

- Regulatory Complexities Across Regions

Exporting or distributing hygiene products across borders involves navigating varying regulatory requirements. Chemical registration, labeling standards, and ingredient restrictions differ significantly between the EU, US, Asia, and Middle East, creating compliance hurdles for global brands.

- Environmental Waste from Single-Use Products

The surge in demand for wipes, plastic soap bottles, and disposable gloves during the pandemic contributed to increased environmental waste. With sustainability in focus, companies must now invest in recyclability, compostability, and waste reduction solutions.

- Consumer Fatigue and Behavioral Decline

While hygiene habits peaked during the pandemic, some consumers are reverting to pre-pandemic behaviors. This softening demand, especially in mature markets, could flatten growth unless supported by continuous innovation and education campaigns.

Regional Analysis

North America

North America remains a dominant market, driven by strong institutional demand and high consumer awareness. The U.S. and Canada have well-established regulations governing infection control solutions in hospitals and commercial spaces. The region is also a hub for innovation in eco-friendly and technology-enabled cleaning systems.

Europe

Europe is characterized by strict regulatory oversight and a strong push toward sustainability. Countries such as Germany, the UK, and the Netherlands are witnessing growing demand for biodegradable cleaning products and plant-based disinfectants. The EU’s Green Deal is further accelerating the transition to environmentally responsible sanitation supplies.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by population growth, urbanization, and rising disposable income. Countries such as China, India, Japan, and South Korea are investing heavily in public sanitation infrastructure. The pandemic amplified consumer demand for personal hygiene products, particularly in dense urban areas and megacities.

Latin America

Latin America, led by Brazil and Mexico, is experiencing rising demand for affordable and accessible cleaning solutions. However, economic fluctuations and supply chain limitations pose challenges. Regional manufacturers are increasingly focusing on cost-effective formulations and local production.

Middle East & Africa

The Middle East is adopting global hygiene standards in sectors such as healthcare, hospitality, and food services. Government-led initiatives in the Gulf Cooperation Council (GCC) countries promote cleanliness and health awareness. Africa shows growth potential, particularly in urban areas, though infrastructure and affordability remain limiting factors.

Key Companies

- Beiersdorf AG

- Church & Dwight Co., Inc.

- Clorox Company

- Colgate-Palmolive Company

- Diversey Holdings, Ltd.

- DowDuPont

- Ecolab Inc.

- Henkel AG & Co. KGaA

- Kao Corporation

- Kimberly-Clark Corporation

- McBride plc

- Procter & Gamble

- Reckitt Benckiser Group plc

- S.C. Johnson & Son, Inc.

- Unilever

Conclusion

The Cleaning and Hygiene Products Market is more than a trend—it is now a cornerstone of global health and safety. As consumers, institutions, and governments continue to prioritize cleanliness, the market is set to evolve further through sustainable innovation, smart automation, and personalized hygiene experiences.

With the continued development of advanced infection control solutions, eco-conscious personal hygiene products, and effective surface disinfectants, the industry is poised for long-term relevance. Companies that lead in transparency, efficacy, and environmental responsibility will not only shape the market’s trajectory but also enhance global well-being in the years to come.

More Trending Latest Reports By Polaris Market Research: