Mordor Intelligence has published a new report on the Insurance Third-Party Administrators Market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Insurance Third-Party Administrators Market Overview

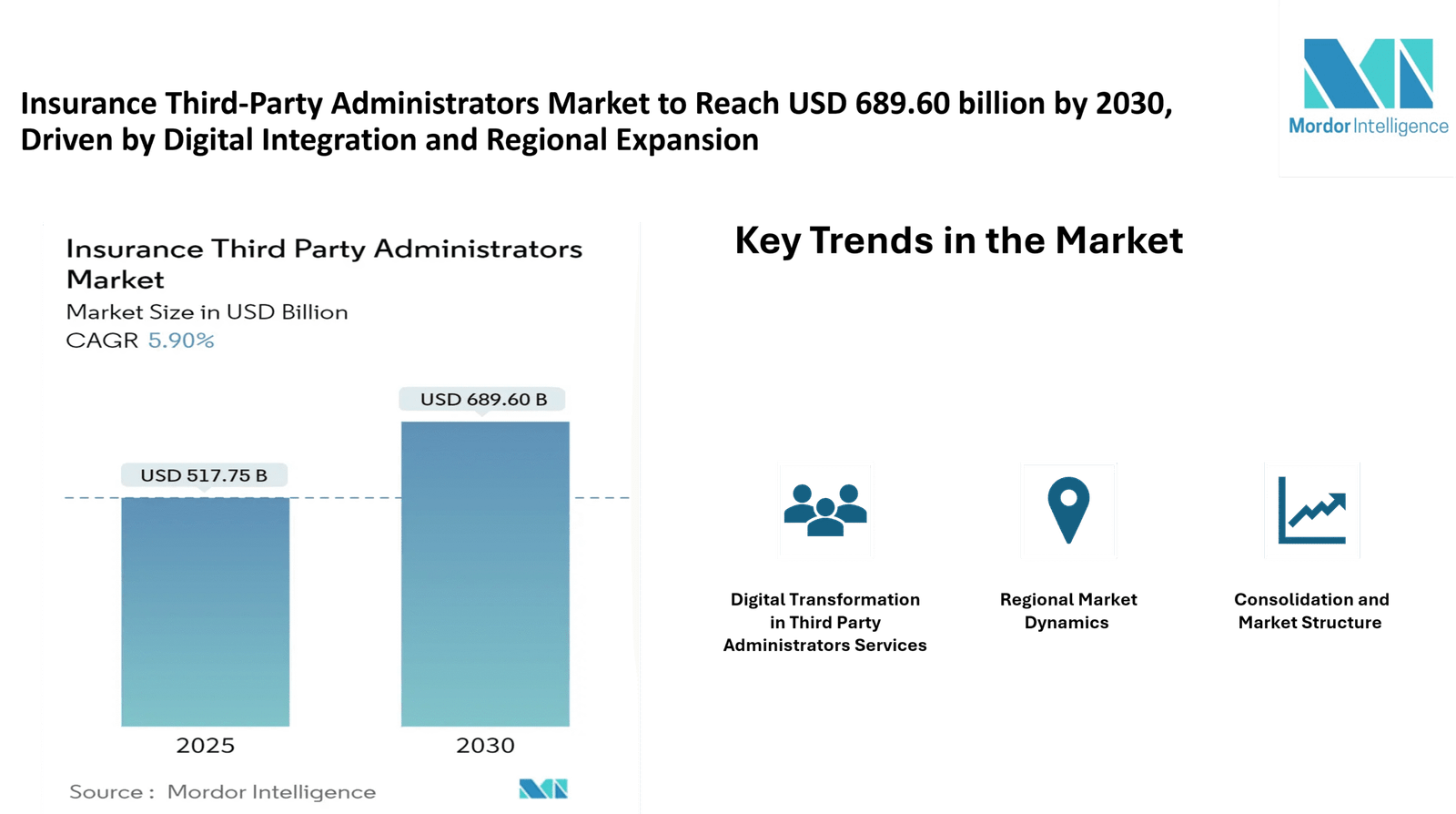

The Insurance Third-Party Administrators Market size is estimated at a value of USD 517.75 billion in 2025 and is expected to reach a value of USD 689.60 billion by 2030, growing a compound annual growth rate (CAGR) of 5.9%. Third-party administrators play a crucial role in the insurance ecosystem by managing various administrative functions such as claims processing, policyholder services, and risk management on behalf of insurers. Their services enable insurance companies to focus on core competencies while ensuring efficient and effective service delivery to policyholders.

Insurance Third-Party Administrators Market Key Trends

Digital Transformation in Third-Party Administrator Services

The integration of digital technologies is reshaping the Third-Party Administrators landscape. Key technological enablers include intelligent automation, mobile platforms, predictive analytics, drone technology, and cloud-based claims management systems. These advancements are enhancing the efficiency and accuracy of administrative processes, leading to improved service quality and customer satisfaction.

Regional Market Dynamics

North America currently holds the largest share of the Third-Party Administrators market, driven by sophisticated healthcare systems and advanced insurance frameworks. The United States, in particular, dominates the North American market, accounting for approximately 95% of the region’s share in 2024. The market is characterized by a low level of concentration and high fragmentation, with the top 10 Third Party Administrators commanding only 3-5% of the market.

In contrast, Asia-Pacific is emerging as the fastest-growing region, fueled by increasing insurance penetration, growing middle-class populations, and rising awareness of insurance products. Countries like China and India are at the forefront of this growth, with significant investments in digital infrastructure and regulatory reforms supporting market expansion.

Consolidation and Market Structure

The Third-Party Administrators industry exhibits varying levels of market concentration across different regions. For instance, in the United Arab Emirates, approximately 98% of health insurance providers outsource their policies to third-party administrators, with seven companies controlling about 90% of the business in Dubai among 23 registered Third-Party Administrators. This consolidation trend is driven by the need for operational efficiency and the advantages of economies of scale in managing large volumes of claims and policy administration.

Insurance Third-Party Administrators Market Segmentation

By Insurance Type:

- Healthcare Insurance: Third-party administrators manage claims processing, provider networks, and policyholder services for health insurance plans.

- Retirement Plans: Administrative services for pension and retirement benefit schemes.

- Commercial General Liability Insurance: Handling of claims and policy administration for business liability coverage.

- Other Insurance Types: Includes motor insurance and other specialized insurance products.

By Geography:

- North America: United States, Canada

- Europe: United Kingdom, Germany, Rest of Europe

- Asia-Pacific: China, India, Rest of Asia-Pacific

- Middle East and Africa: United Arab Emirates, Saudi Arabia, Rest of Middle East and Africa

- Latin America: Brazil, Mexico, Rest of Latin America

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/insurance-tpa

Insurance Third-Party Administrators Key Players

The Third-Party Administrators market comprises a mix of global and regional players offering a range of administrative services. Notable companies in the industry include:

- Sedgwick Claims Management Services Inc.: A leading provider of technology-enabled risk and benefits solutions, offering claims management services across multiple industries worldwide.

- Crawford & Company: Specializes in claims management and outsourcing services, handling complex claims across various sectors, including healthcare and insurance.

- Maritain Health: Focuses on health insurance third-party administration, providing efficient claims processing and customer service.

- UMR Inc.: A subsidiary of UnitedHealthcare, offering a range of health insurance management services, including claims processing for self-funded employees.

- Gallagher Bassett Services Inc.: Provides comprehensive claims management services, emphasizing risk control and cost containment strategies.

Conclusion

The insurance third-party administrators’ market is on a growth trajectory, driven by digital integration, regional market expansion, and evolving service offerings. As insurers seek to enhance operational efficiency and customer experience, third-party administrators are becoming increasingly integral to the insurance value chain. The continued adoption of advanced technologies and strategic partnerships will likely shape the future landscape of the Third-Party Administrators industry.

Industry Related Reports

UAE Health Insurance Third Party Administrators Market: The UAE Health Insurance Third Party Administrators Market Report is Segmented by Geography (Dubai, Abu Dhabi, and Other Cities).

Europe Bancassurance Market: The Europe Bancassurance Market Report is Segmented by the Type of Insurance (Life Insurance and Non-Life Insurance) and Geography (France, Italy, Germany, Finland, United Kingdom, and Rest of Europe).

ASEAN Bancassurance Market: Bancassurance in the ASEAN market is segmented based on the type of insurance being sold as a bundled product to the consumer ( life, non-life, and others) and the country-wise scenario (Indonesia, Malaysia, Thailand, Vietnam, Phillippines, Myanmar, Singapore, Cambodia, Laos, Brunei).

Insurance BPO Services Market: Insurance Business Process Outsourcing Services Market Report is Segmented by Service (Customer Care Services (Claims Management Services), Finance and Accounting Services, Underwriting Services, Human Resource Outsourcing Services, and Other Services (IT Services, Etc.)), Insurance Type (Property and Casualty Insurance Provider, and Life and Annuity Insurance Provider), and Geography (Europe, Middle East and Africa, Asia-Pacific, Latin America, and North America).

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/