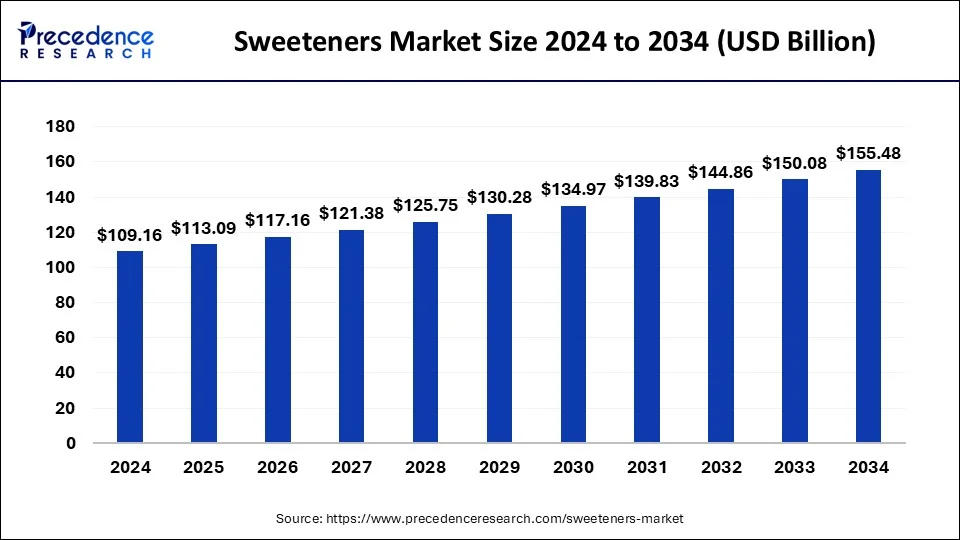

The global sweeteners market size was valuaed at USD 109.16 billion in 2024 and is projected to hit around USD 155.48 billion by 2034, growing at a CAGR of 3.60% from 2025 to 2034. The sweeteners market growth is driven by increased demand for clean-label and sugar free products, advancements in sweetener technologies and focus on developing protein-based sweeteners.

Sweeteners Market Key Points

- In terms of revenue, the sweeteners market is worth $ 113.09 billion in 2025.

- The market is projected to reach to $155.48 billion by 2034.

- The market is expected to grow at a compound annual growth rate (CAGR) of 3.60% from 2025 to 2034

- The Asia Pacific dominated the global market with largest market of 31% in 2024.

- By type, the sucrose segment generated the biggest market share in 2024.

- By form, the solid segment accounted for the largest market share of 71% in 2024.

- By application, the bakery and confectionery segment contributed highest market share in 2024.

Market Overview

Sweeteners can be referred as substances incorporated in foods and drinks for developing a sweet and pleasant taste for consumption. They can be classified into nutritive sweeteners like sugars which include glucose and fructose, and non-nutritive sweeteners like sugar substitutes such as sorbitol, aspartame, stevia among others.

The sweetener market growth is fostered by the rising prevalence of diabetes and obesity creating need for sweeteners managing caloric intake and blood sugar levels, rising awareness among consumers of health risks associated with excessive sugar consumption, focus of manufacturers on producing natural sweeteners with low-calories, support from regulatory bodies fostering research and development for creation of novel sweeteners.

Moreover, increased adoption of sweeteners in the rapidly expanding food & beverage industry, use of artificial intelligence (AI) platforms for sweetener discovery, rise in global sugar production rates, advancements in sugar reduction technologies and ongoing collaborations among industries for fostering the discovery and commercialization of natural sweeteners is driving the market expansion.

Major Key Trends in Sweeteners Market

- Health and Wellness Focus: Consumers are increasingly seeking healthier alternatives to sugar and artificial sweeteners, leading to a surge in the demand for natural sweeteners like stevia, monk fruit, and coconut sugar.

- Zero-Calorie and Low-Glycemic Options: Natural sweeteners like stevia and erythritol are favored because they offer low-calorie or zero-calorie content, making them appealing to consumers focused on weight management, diabetes prevention, and overall health.

- Clean Label Movement: There is a growing demand for clean label products, those made with simple, recognizable ingredients. Natural sweeteners, being perceived as healthier and more transparent, align with this movement.

- Sugar Reduction Initiatives: Governments and health organizations are encouraging the reduction of sugar consumption, leading to a demand for low-calorie sweeteners in food and beverages. For example, initiatives like sugar taxes and healthy eating programs in various regions are pushing food manufacturers to use sugar alternatives.

Limitations & Challenges in Sweeteners Market

- Cost Disparity: While natural sweeteners such as stevia, monk fruit, and coconut sugar are gaining popularity due to their health benefits, they are often more expensive than traditional sugar or artificial sweeteners. The production cost of natural sweeteners is generally higher, which can lead to higher prices for consumers.

- Price Sensitivity: This price gap can limit the adoption of natural sweeteners in price-sensitive markets, where consumers are more likely to stick with cheaper, conventional sweeteners.

- Evolving Standards: Regulatory agencies may also change the permitted usage levels of certain sweeteners or reclassify certain sweeteners, which can impact manufacturers and their product formulations.

Development of sweetener platforms: Market’s Largest Potential

Companies are extensively utilizing digital resources and online tools for developing sweetener platforms which are helping users in finding, comparing and for potentially purchasing wide variety of sweeteners from artificial and natural options. These platforms are gaining recognition among consumers with the advancements in the e-commerce sector and are readily available to consumers through online applications and websites.

- A survey by LocalCircles revealed that 38% of urban Indians consume artificial sweeteners monthly.In Bengaluru, this figure rises to 41%, with Delhi at 45% and Mumbai at 42%.These statistics highlight a substantial consumer base for sweetener products.

The improved access to different product listings, availability of comparison tools and educational content for making informed decisions, purchasing options for various order quantities and door-step delivery of products with real-time tracking is driving their use among consumers.

Regional Analysis

What to Expect from Asian Countries till 2034?

Asia Pacific held the largest share of the sweeteners market in 2024, driven by factors such as a large consumer base, a burgeoning food and beverage industry, and increasing health consciousness among consumers. The market is characterized by a diverse range of sweeteners, including both natural and artificial options, catering to varying consumer preferences and regulatory landscapes.

Top Asian Countries for Sweeteners’ Production

- China: China accounts for over 90% of stevia production in the APAC region, making it a key player in the natural sweeteners market. The country’s vast production capacity positions it as a major exporter globally.

- India: In February 2024, Tata Chemicals launched a new line of low-calorie sweeteners, including erythritol and stevia, in Mumbai to meet the increasing demand for healthier options.

- South Korea: The country has emerged as a leading market for allulose, a natural sugar substitute. Major food companies are investing in production facilities to meet growing demand, and the sweetener is widely available in supermarkets.

There is a significant rise in health-related concerns such as obesity, diabetes, and cardiovascular diseases, which is driving the demand for sweeteners as healthier alternatives to sugar. According to the World Health Organization (WHO), the prevalence of diabetes in the region has significantly increased, further boosting demand for low-calorie sweeteners. The rise of health-conscious consumers is one of the biggest drivers of the sweeteners market. People are becoming more aware of the harmful effects of excessive sugar consumption, including weight gain, diabetes, and heart disease.

North America to Boom Rapidly: Product Innovation to Support the Growth

North America is seen to grow at the fastest rate in the sweeteners market during the forecast period. The market is characterized by a robust consumer base, widespread availability of sweeteners in a variety of forms, and increasing demand for low-calorie and sugar-free alternatives due to growing health concerns. The market includes several countries, with the United States being the largest and most significant player.

Major Factors for the Market’s Expansion in North America:

- One of the most significant drivers of the sweeteners market in North America is the growing awareness about health issues related to excessive sugar consumption. Health concerns such as obesity, diabetes, and heart disease have prompted consumers to seek sugar substitutes.

- The prevalence of diabetes in the U.S. has spurred a large demand for sweeteners that are low-calorie, low-glycemic, or sugar-free.

- The Sugar Reduction Movement has been gaining momentum, with many individuals opting for sweeteners like stevia, monk fruit, and erythritol due to their perceived health benefits.

Consumers in North America are increasingly looking for “clean label” products, meaning foods and beverages with simple, recognizable ingredients. This trend is benefiting natural sweeteners such as stevia and monk fruit, which are considered healthier alternatives to synthetic sweeteners. The rise of e-commerce platforms has made sweeteners more accessible to consumers across North America. Online platforms offer a wide range of sweeteners, including niche and organic options, and provide consumers with the ability to compare prices, read reviews, and access educational content about the products.

Sweeteners Market Segment Outlook

Type Analysis

The sucrose segment dominated the market with the largest share in 2024. Various applications of sucrose sweeteners in food and other industries such as for development of natural and functional sweeteners to cater the increasing consumer demand, in industrial biotechnology for developing biocatalytic processes facilitating the production of bio-based building blocks with sucrose utilization promoting a low-carbon and zero-waste chemical industry as well as innovation in technologies for reducing sweetness loss in sugar-reduced products like cross-modal interactions (stimulation of sweetness through aroma), nanofiltration and enzyme-catalyzed sugar hydrolysis.

Furthermore, rising preference of health conscious consumer towards low-calorie alternatives compared to traditional sugar, progress in microbial synthetic biology streamlining sustainable production of natural sugar substitutes through microbial fermentation, implementation of metabolic engineering strategies facilitating the use of yeast as a platform for production of natural sugar derivatives, expansion of the food and beverage industry and, use of sucrose in medicinal formulations for improving the taste of chemicals are the factors fostering the market growth of this segment.

The tagatose segment is anticipated to witness lucrative growth during the forecast period. The market growth of this segment can be linked to the increased research activities for exploring rare sugars such as D-tagatose with antioxidant and cryoprotectant properties along with enhanced glycemic control and applications in dental health and diabetes management.

Application Analysis

The bakery and confectionary segment accounted for the largest market share in 2024. The market growth of this segment is driven by the rising consumer demand for clean-label products with natural sweeteners and less additives, rapid urbanization leading to consumer preference for ready-to-eat options like bakery and confectionary products, ongoing advancements in sweetener formulations and new products with different flavors, increased accessibility to bakery products with the growth of e-commerce sector facilitating online shopping and food delivery services, focus of manufacturers on utilizing small and affordable packaging for targeting rural and semi-urban areas.

The pharmaceuticals segment is expected to show the fastest growth during the forecast period. Sweeteners are widely used in various pharmaceutical formulations for improvement of stability and shelf-life of pharmaceutical products due to ability of certain sweeteners to inhibit microbial growth as well as for boosting patient compliance by enhancing the taste of medications by masking bitterness, especially for paediatric and geriatric populations.

Additionally, increasing demand for natural sweeteners like monk fruit sweetener and stevia, emergence of novel sweeteners like D-tagatose and allulose for diabetic patients and, rise in FDA approvals for artificial sweeteners like neotame and advantame among others are fostering the market expansion.

Form Analysis

The solid form segment held the largest market share in 2024. The universal availability of crystalline, solid or powdered forms of sweeteners as well as various practical advantages convenient packaging and transportation, ease of storage, superior stability and shelf-life compared to liquid forms, and applications in various industries such as food, beverage and pharmaceutical industries is driving the market growth.

Moreover, surging demand for functional foods and low-calorie alternatives with increasing awareness among health conscious individuals to prevent health risks related with excessive sugar consumption are fostering the market expansion.

The liquid form segment is predicted to grow at the fastest rate during the forecast period. Liquid sweeteners offer enhanced solubility and flexibility as compared to solid sweetener facilitating broad range of applications such as in chewing gums, mouthwashes, pharmaceutical products, beverages and also in cosmetic gels. The rising demand for beverages, advancements in production technologies and increased consumer preference towards healthier options are boosting the market growth.

Recent Breakthroughs in Global Sweeteners Market:

- In December 2024, Tate & Lyle PLC collaborated with BioHarvest Sciences with the aim of developing next-generation of industrial sweetening products by utilizing plant-derived molecules. BioHarvest’s proprietary Botanical Synthesis Platform will be used for producing non-GMO plant-derived ingredients for meeting the consumer demand of healthier products with sugar-like taste and no after-taste.

- In October 2024, NutraEx Food Inc., a provider of natural sweeteners, launched Bi-Sugar manufactured through the company’s dry-embedding technology bonding L-arabinose to regular sugar and other natural sweetener. The Bi-sugar sweetener offers advantages like calorie reduction, sugar blocking, sweetness, reduced costs. The product can be used in various applications like bakery, confectionary, beverages, dairy and also provides caramel notes.

Source: https://www.precedenceresearch.com/sweeteners-market