Absorbable Sutures Market Summary

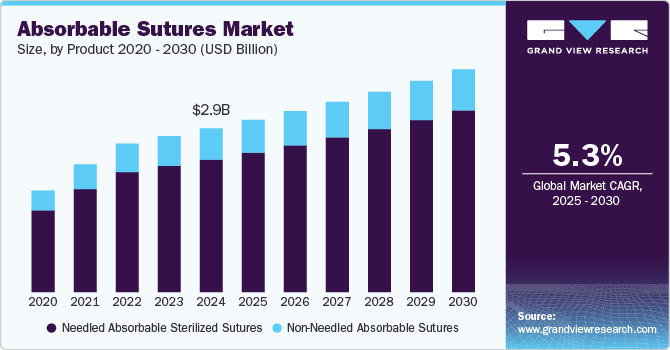

The global absorbable sutures market size was estimated at USD 2.9 billion in 2024 and is projected to reach USD 3.9 billion by 2030, growing at a CAGR of 5.3% from 2025 to 2030. The absorbable sutures industry is expanding due to several key drivers, including increasing demand for minimally invasive surgeries and advancements in suture materials.

Key Market Trends & Insights

- North America absorbable sutures market dominated globally, capturing 32.9% of the revenue share in 2024.

- The absorbable sutures market in the U.S. held a significant share in the North America region in 2024.

- Based on product, the needled absorbable sterilized sutures segment held the largest revenue share of 80.9% in 2024.

- Based on filament, the multifilament segment held the largest revenue share of 57.0% in 2024.

- Based on application, the cardiac surgery segment dominated and accounted for the largest revenue share of 26.7% in 2024.

Request Free Sample Report: https://www.grandviewresearch.com/industry-analysis/absorbable-sutures-market-report

Market Size & Forecast

- 2024 Market Size: USD 2.9

- 2030 Projected Market Size: USD 3.9 Billion

- CAGR (2025-2030): 5.3%

- North America: Largest market in 2024

The shift towards less invasive procedures promotes faster recovery and reduced complications, boosting the use of absorbable sutures in various specialties such as general surgery, orthopedics, and ophthalmology. Technological innovations in suture materials, such as enhanced tensile strength and biocompatibility, are also contributing to market growth. Absorbable sutures are a type of sutures that gradually dissolve in the body over time, eliminating the need for removal. These sutures are made from materials like polyglycolic acid (PGA), polylactic acid (PLA), polyglactin, and polydioxanone (PDO), which are bioabsorbable and provide a range of benefits, including reduced patient discomfort, lower risk of infection, and quicker recovery times.

Product Insights

The needled absorbable sterilized sutures segment held the largest revenue share of 80.9% in 2024 and is expected to grow at the fastest CAGR over the forecast period. These sutures are pre-attached to a needle, ensuring precise and efficient application in a variety of surgeries, such as general, cardiovascular, and orthopedic procedures. The sterilization process ensures that the sutures are safe and free from contaminants, making them suitable for use in sterile environments. The convenience of pre-needled sutures, combined with their absorbable nature, which eliminates the need for removal, has driven their dominance in the market, ensuring high demand in healthcare settings.

Filament Insights

The multifilament segment held the largest revenue share of 57.0% in 2024 due to its superior strength, flexibility, and ease of handling. Made from multiple intertwined threads, multifilament sutures provide enhanced knot security and are less likely to slip during procedures. These sutures are particularly favored in high-tension surgical areas like cardiovascular and orthopedic surgeries. Their increased surface area facilitates better tissue holding, contributing to improved healing outcomes. The demand for multifilament absorbable sutures is driven by their reliability, ease of use, and performance, making them a preferred choice among surgeons across various medical specialties.

Application Insights

The cardiac surgery segment dominated the absorbable sutures industry and accounted for the largest revenue share of 26.7% in 2024 due to the high demand for surgical procedures involving the heart. Absorbable sutures are crucial in cardiac surgeries for closing incisions and securing tissue, as they eliminate the need for removal, reducing patient discomfort and risk of infection. These sutures provide reliable wound closure, supporting faster healing and minimizing complications. With the increasing prevalence of cardiovascular diseases and advancements in cardiac surgery techniques, the demand for absorbable sutures in cardiac surgeries is expected to continue growing. In addition, the focus on minimally invasive surgeries further boosts the adoption of absorbable sutures in this segment.

Regional Insights

North America absorbable sutures market dominated globally, capturing 32.9% of the revenue share in 2024. According to the American Hospital Association Statistics 2024, the U.S. has approximately 6,120 operational hospitals, performing 40–50 million surgeries annually for conditions such as cardiovascular diseases, cancer, and trauma (NCBI, 2020). Rising surgeries drive demand for surgical instruments. In addition, 702,880 heart disease deaths in 2022 highlight the growing demand for minimally invasive techniques, boosting market growth.

Key Absorbable Sutures Company Insights

The competitive scenario in the global absorbable sutures industry is high, with key players such as Johnson & Johnson, B Braun Melsungen AG, and Teleflex Incorporated holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Absorbable Sutures Companies:

The following are the leading companies in the absorbable sutures market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson

- Teleflex Incorporated

- B Braun Melsungen AG

- DemeTECH Corporation

- Lotus Surgicals Pvt Ltd

- Teleflex Incorporated

- Integra Lifesciences Corporation

- Healthium Medtech (formerly Suture India)

- Samyang Holdings Corporation

- Internacional Farmacéutica S.A. de C.V. (Atramat)

Global Absorbable Sutures Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global absorbable sutures market report based on product, filament, application, end use, and region:

- Product Outlook (Revenue, USD Million, 2018 – 2030)

- Needled Absorbable Sterilized Sutures

- Non-Needled Absorbable Sutures

- Filament Outlook (Revenue, USD Million, 2018 – 2030)

- Monofilament

- Multifilament

- Application Outlook (Revenue, USD Million, 2018 – 2030)

- Ophthalmic Surgery

- Cardiac Surgery

- Orthopedic Surgery

- Neurological Surgery

- Others

- End Use Outlook (Revenue, USD Million, 2018 – 2030)

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Centers

- Others

- Regional Outlook (Revenue, USD Million, 2018 – 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- North America

Browse Full Repot: https://www.grandviewresearch.com/industry-analysis/absorbable-sutures-market-report