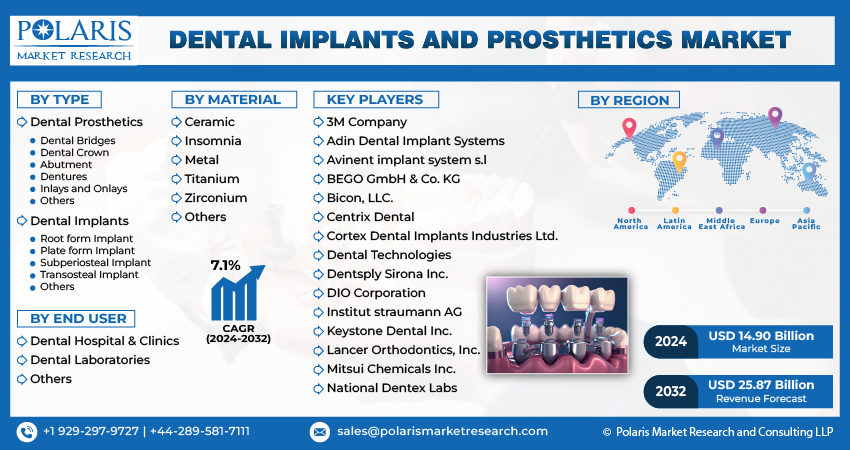

Dental Implants and Prosthetics—Market Insights, Size Revenue, Outlook, Overview, and Analysis. The global dental implants and prosthetics market was estimated to be worth USD 13.94 billion in 2023 and is predicted to expand to USD 25.87 billion by 2032, with a CAGR of 7.1% from 2024 to 2032.

Report Scope:

This comprehensive study provides an accurate overview of the worldwide dental implants and prosthetics market. Comprehensive analyses of sales volume, price, revenue, market share, and important companies are included. The market is further divided into segments by type, material, end-user, and region in the study, which offers a comprehensive picture of the state of the market.

𝐆𝐞𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭:

Market Definition:

Oral or endosseous implants, also called dental implants, have been utilized for over half a century in the replacement of lost teeth. They are seen as a significant advancement in dentistry for their ability to improve the success rate of tooth replacement. The implant material’s success depends on its crucial ability to integrate with the surrounding tissue. Dental prosthetics are instruments used in dentistry to treat issues like tooth gaps, enhance appearance, and aid in eating and talking. Prosthodontic medical devices, such as crowns, bridges, dentures, abutments, veneers, and inlays & onlays, are frequently used in dentistry. Additionally, dental prosthetics can be either fixed or removable, such as complete or partial dentures.

Drivers and Trends:

- Progress in the field of materials science has led to the development of dental implants, crowns, bridges, and dentures composed of stronger, longer-lasting, and biocompatible materials. Technological progress has increased patient approval and confidence in dental procedures, leading to a surge in the demand for dental implants and prosthetics.

- The development of All-on-4 and All-on-6 implant systems has made it possible to restore an entire arch with fewer implants, resulting in a faster restoration of a natural smile. The advancements in dental technology are viewed as a key factor impacting the market.

Top Companies:

The market is marked by fierce competition, and the leading companies rely on innovative technology, superior goods, and a strong brand identity to boost sales.

Here are the top companies in the dental implants and prosthetics market:

- 3M Company

- Adin Dental Implant Systems

- Avinent implant system s.l

- BEGO GmbH & Co. KG

- Bicon, LLC.

- Centrix Dental

- Cortex Dental Implants Industries Ltd.

- Dental Technologies

- Dentsply Sirona Inc.

- DIO Corporation

- Institut straumann AG

Country-Wise Insights:

According to regional analysis, in 2023, Europe is anticipated to lead the global market due to the area’s advanced healthcare market; people in the region can easily get advanced dental care like dental implants.

Also, during the projection period, Asia Pacific is anticipated to experience substantial growth in the market. Dental implants are now more widely available and cost-effective due to advanced technologies and innovative products, resulting in a higher demand for these services.

Dental Implants and Prosthetics Market, Regional Outlook (Revenue – USD Billion, 2019-2032)

- North America

- Type Outlook

- Dental Prosthetics

- Dental Bridges

- Dental Crown

- Abutment

- Dentures

- Inlays and Onlays

- Others

- Dental Implants

- Root form Implant (Endosteal Implant)

- Plate form Implant

- Subperiosteal Implant

- Transosteal Implant

- Others

- Dental Prosthetics

- Material Outlook

- Ceramic

- Insomnia

- Metal

- Titanium

- Zirconium

- Others

- End User Outlook

- Dental Hospital & Clinics

- Dental Laboratories

- Others

- Type Outlook

- Europe

- Type Outlook

- Dental Prosthetics

- Dental Bridges

- Dental Crown

- Abutment

- Dentures

- Inlays and Onlays

- Others

- Dental Implants

- Root form Implant (Endosteal Implant)

- Plate form Implant

- Subperiosteal Implant

- Transosteal Implant

- Others

- Dental Prosthetics

- Material Outlook

- Ceramic

- Insomnia

- Metal

- Titanium

- Zirconium

- Others

- End User Outlook

- Dental Hospital & Clinics

- Dental Laboratories

- Others

- Type Outlook

Research Scope:

The research scope in this sector remains extensive and dynamic, with ongoing investigations into cutting-edge biomaterials, surface coatings, and tissue regeneration techniques. Digital modeling, artificial intelligence, and 3D printing are streamlining the design and manufacturing of implants and prosthetics, facilitating higher precision and faster turnaround times. Future studies may focus on the long-term clinical performance of new implant designs, patient-reported outcomes, and novel methods to improve bone integration. This continual exploration promises to reshape standards of care, fostering a more patient-centered approach and ultimately leading to superior long-term solutions.

Future Outlook:

The dental implants and prosthetics market is expected to experience robust growth in the coming years, supported by innovations in implant materials, integration of digital dentistry workflows, and advanced imaging technologies. As global awareness of oral health rises, patients are increasingly seeking high-quality, durable solutions that restore both functionality and aesthetics. Emerging markets, coupled with improved reimbursement frameworks, offer significant opportunities for expansion. Combined with the push toward personalized treatment planning and minimally invasive procedures, these trends are likely to drive sustainable market development and heightened patient satisfaction.

Recent Developments:

June 2024:

BioLargo, Inc. announced that its subsidiary Clyra Medical Technologies has partnered with Keystone Industries for the manufacturing of its medical products. Keystone, a global producer of dental, medical, and cosmetic products with distribution in over 70 countries, is collaborating with Clyra to invest in infrastructure supporting the development of innovative healthcare solutions.

February 2024:

ZimVie Inc., a global leader in life sciences, introduced the TSX Implant in Japan. Designed for immediate extraction and standard loading protocols, these implants enhance placement predictability and primary stability in both soft and dense bone. The launch positions ZimVie to compete directly with leading players in the digital implant market, advancing its footprint in the implantable device sector.

These developments reflect ongoing innovation and strategic collaborations in the medical technology industry, focusing on advanced solutions to improve healthcare outcomes and expand market presence.