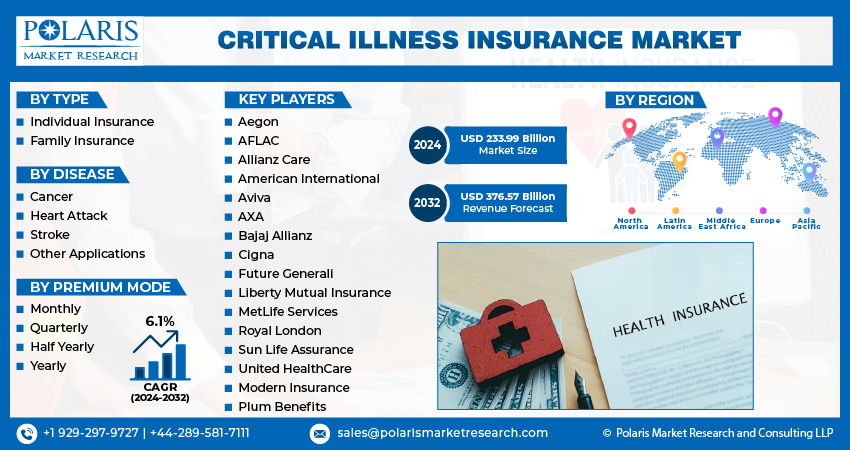

The global critical illness insurance market size is expected to reach USD 376.57 billion by 2032, is expected to grow at a CAGR of 6.1% during the forecast period.

The critical illness insurance market has emerged as a crucial segment within the global insurance industry, addressing the increasing financial burden posed by life-threatening medical conditions. Critical illness insurance provides policyholders with a lump-sum payment upon diagnosis of specified illnesses such as cancer, heart attack, stroke, and other severe conditions. This financial support enables patients and their families to manage medical expenses, lifestyle adjustments, and loss of income during recovery.

The market has seen significant growth over the past decade, fueled by rising healthcare costs and growing awareness of the importance of financial preparedness for unforeseen medical crises. Insurers are increasingly tailoring policies to meet diverse consumer needs, offering flexible coverage plans and add-ons that cater to varying demographics.

𝐆𝐞𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭:

Competitive Insight

Major players operating in the global critical illness insurance market

- Aegon,

- AFLAC,

- Allianz Care,

- American International,

- Aviva,

- AXA,

- Bajaj Allianz,

- Cigna,

- Future Generali,

- Liberty Mutual Insurance,

- MetLife Services,

- Royal London,

- Sun Life Assurance,

- United HealthCare,

- Modern Insurance, and

- Plum Benefits.

Market’s Growth Drivers

Several factors are driving the growth of the critical illness insurance market:

- Rising Prevalence of Critical Illnesses: The increasing incidence of chronic and lifestyle-related diseases, such as cancer, cardiovascular diseases, and diabetes, has heightened the demand for critical illness insurance.

- Escalating Healthcare Costs: The cost of advanced medical treatments and procedures has surged, making it essential for individuals to secure financial protection.

- Growing Awareness: Awareness campaigns by insurers and governments have educated consumers about the benefits of critical illness coverage, contributing to higher adoption rates.

- Increasing Disposable Income: As disposable incomes rise, particularly in developing economies, more people are investing in health and life insurance products.

- Integration of Technology: The use of digital platforms and tools has streamlined policy issuance and claims processing, enhancing customer experience and market accessibility.

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐥 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬:

The research study includes segmental analysis that divides the market into distinct groups or segments based on common characteristics. With market segmentation, businesses can identify specific customer groups that are more likely to be interested in specific products or services. Also, it enables these businesses to focus their marketing efforts and resources more efficiently, leading to higher conversion rates and improved return on investment. Furthermore, segmentation analysis helps companies develop personalized products or services, which can result in increased customer loyalty and improved customer satisfaction.

Critical Illness Insurance Market, Type Outlook (Revenue – USD Billion, 2019-2032)

- Individual Insurance

- Family Insurance

Critical Illness Insurance Market, Disease Outlook (Revenue – USD Billion, 2019-2032)

- Cancer

- Heart Attack

- Stroke

- Other Applications

Critical Illness Insurance Market, Premium Mode Outlook (Revenue – USD Billion, 2019-2032)

- Monthly

- Quarterly

- Half Yearly

- Yearly

Key Trends

The critical illness insurance market is shaped by several notable trends:

- Customizable Policies: Insurers are offering modular policies that allow customers to choose coverage for specific illnesses based on their risk profiles and preferences.

- Bundled Health Products: Many insurers are integrating critical illness coverage with broader health and life insurance plans, providing comprehensive financial protection.

- Focus on Preventive Healthcare: Some insurers are incentivizing policyholders to adopt healthier lifestyles through wellness programs and discounts.

- Expansion into Emerging Markets: Companies are targeting underserved regions in Asia-Pacific, Latin America, and Africa, where rising healthcare awareness is driving demand for insurance.

- Digital Transformation: The adoption of AI, blockchain, and mobile apps is improving underwriting accuracy, fraud detection, and customer engagement.

Research Scope

The critical illness insurance market encompasses a wide range of stakeholders, including insurance providers, reinsurers, healthcare providers, policymakers, and consumers. Research in this domain explores:

- Market Segmentation: Analysis by coverage type (individual vs. group policies), age groups, and regions.

- Consumer Behavior: Insights into purchasing patterns, preferences, and awareness levels.

- Competitive Landscape: Evaluation of key players, their product portfolios, and market strategies.

- Economic Impact: Assessment of how critical illness insurance alleviates the financial burden on households and healthcare systems.

- Regulatory Environment: Analysis of policies and regulations affecting market dynamics.

Future Scope

The future of the critical illness insurance market looks promising, driven by advancements in technology and evolving consumer needs. Key areas of growth include:

- Personalized Insurance Plans: Leveraging big data and AI to offer tailored policies based on individual health profiles and risk assessments.

- Global Expansion: Increasing penetration in emerging economies with large uninsured populations.

- Integration with Wearable Technology: Using health monitoring devices to track wellness metrics and reward healthy behaviors.

- Sustainable Premium Models: Developing affordable plans to cater to low- and middle-income segments.

- Collaborations with Healthcare Providers: Strengthening partnerships to offer policyholders seamless access to healthcare services and financial support.

Recent Developments

In May 2022, Aflac launched an updated version of its Aflac Group Critical Illness Insurance, designed to better meet the evolving needs of employees in the wake of the COVID-19 pandemic. The revamped product offers an expanded range of standard and optional benefits for employers, enhancing coverage options for employees.

In November 2020, the China Medical Doctor Association and the Insurance Association of China introduced the Revised Industry Standard Definitions of Critical Illness. These definitions were developed after a comprehensive analysis of 400 million policies, claims, and 2,900 clinical illness products across the industry.

In January 2020, HDFC Ergo, a general insurance company based in Mumbai, acquired a 50.08% stake in Apollo Munich Health Insurance for $183 million (approximately 1,494 crore rupees). This acquisition aims to combine the strengths of both companies, enhancing the value and offerings to their customers. Apollo Munich Health Insurance is a prominent insurance provider in India.

More Trending Latest Reports By Polaris Market Research:

Neurological Biomarkers Market

Algorithmic IT Operations (AIOps) Market