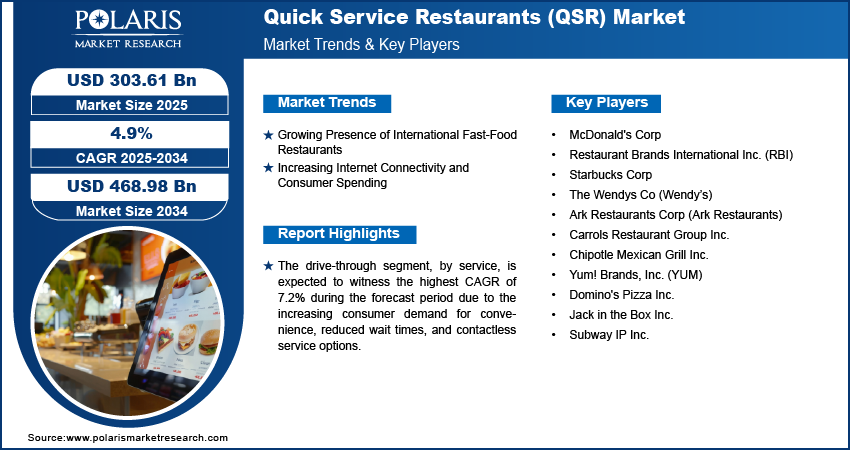

Global Quick Service Restaurants (QSR) Market size and share is currently valued at USD 289.68 billion in 2024 and is anticipated to generate an estimated revenue of USD 468.98 billion by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 4.9% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 – 2034

Market Overview:

The QSR market includes a wide range of food establishments, such as fast food chains, coffee shops, pizza parlors, and sandwich shops, that focus on delivering quick and affordable meals to customers. These restaurants typically serve pre-prepared or easily assembled food items, including burgers, fries, pizzas, sandwiches, salads, and beverages, which can be quickly prepared and served.

QSRs have become a significant part of daily life for many consumers, particularly in urban areas where busy lifestyles demand convenience and efficiency. The market has expanded globally, with both international brands and local establishments catering to diverse tastes and preferences. While traditionally associated with hamburgers and fried foods, QSR menus are diversifying to include healthier options, vegetarian meals, and global cuisines, catering to a wider range of dietary preferences.

Key Trends:

The QSR market is being shaped by several key trends that reflect evolving consumer preferences and technological innovations:

Digital Transformation and Delivery Services

The digital transformation of the QSR industry is one of the most prominent trends. The rise of online ordering and food delivery services, particularly through third-party platforms like Uber Eats, DoorDash, and Grubhub, has revolutionized the QSR business model. Consumers now have the option to place orders from the comfort of their homes or offices, further increasing the convenience of fast food.

Customization and Personalization

Consumers are increasingly seeking personalized experiences when dining out, and QSRs are responding by offering more customizable menu options. From build-your-own-burgers to customizable pizzas, QSRs are catering to individual tastes and dietary preferences. This trend also extends to beverages, with many QSRs offering customizable drink options, such as different levels of sweetness, flavor combinations, and dietary-friendly choices like sugar-free or dairy-free alternatives.

Plant-Based and Sustainable Options

With the rise in plant-based eating and sustainable food practices, QSRs are incorporating more plant-based options into their menus. Vegetarian and vegan meals, such as plant-based burgers and dairy-free milkshakes, are becoming increasingly popular. In addition to plant-based foods, many QSRs are focusing on sustainable sourcing practices, offering eco-friendly packaging, and reducing food waste to appeal to environmentally conscious consumers.

𝐆𝐞𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭:

Key Companies in Quick Service Restaurants Market

- McDonald’s Corp

- Restaurant Brands International Inc. (RBI)

- Starbucks Corp

- The Wendys Co (Wendy’s)

- Ark Restaurants Corp (Ark Restaurants)

- Carrols Restaurant Group Inc.

- Chipotle Mexican Grill Inc.

- Yum! Brands, Inc. (YUM)

- Domino’s Pizza Inc.

- Jack in the Box Inc.

- Subway IP Inc.

Quick Service Restaurants Market Developments:

- November 2024: McDonald’s announced the upcoming launch of its McValue platform across U.S. locations, starting in January 2025. This initiative will feature popular promotions like the USD 5 Meal Deal, exclusive in-app offers, and regional discounts. A standout offering includes the “For USD 1 Buy One, Add One” deal on select meals throughout the day. The McValue platform is designed to provide customers with more value and variety, meeting the growing demand for convenience and affordability.

- July 2022: Chipotle introduced a USD 50 million venture fund in April 2022 to address various challenges in the restaurant industry. As part of its investment strategy, Chipotle made a significant move by investing in Nuro, a self-driving robotics company, as its first venture investment. This year, the company is piloting Chippy, a robotic tortilla chip maker, aimed at saving time and reducing labor costs.

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐥 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰:

The Quick Service Restaurants (QSR) Market segmentation divides the market into several segments. The industry segmentation is primarily based on product type, application, end-use, and geographic factors. Besides, the research study covers several sub-segments of the market. An in-depth examination of each market segment and sub-segment has been provided, covering the industry size, growth prospects, industry drivers, and challenges. The detailed market segmentation helps stakeholders identify the diverse needs of different consumer groups in the market. Also, it pinpoints opportunities for targeted marketing and product development strategies.

By Type Outlook (Revenue, USD Billion; 2020–2034)

- Independent

- Chain

By Cuisine Outlook (Revenue, USD Billion; 2020–2034)

- American

- Chinese

- Italian

- Mexican

- Japanese

- Turkish & Lebanese

- Others

By Service Outlook (Revenue, USD Billion; 2020–2034)

- Eat-in

- Takeaway

- Drive-Through

- Home Delivery

The Quick Service Restaurant (QSR) market continues to grow, driven by changing consumer lifestyles, advancements in technology, and a growing focus on convenience, health, and sustainability. As consumer preferences evolve, QSRs are adapting by offering more diverse, healthier, and customizable menu options, while also embracing technological innovations to enhance the customer experience.