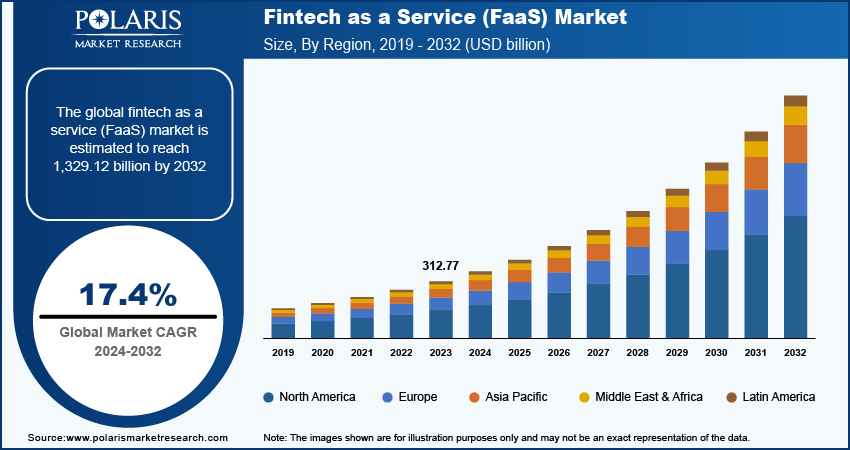

The global Fintech as a Service (FaaS) market was valued at USD 312.77 billion in 2023 and is projected to grow from USD 367.06 billion in 2024 to USD 1,329.12 billion by 2032, exhibiting a Compound Annual Growth Rate (CAGR) of 17.4% during the forecast period from 2024 to 2032.

Market Overview

The Fintech as a Service (FaaS) market is experiencing substantial growth, driven by the increasing demand for digital financial services. FaaS enables businesses to integrate a variety of financial services, including payments, lending, insurance, and wealth management, through a scalable and modular platform. This allows organizations to offer financial products to their customers without having to build the infrastructure from scratch, thus lowering operational costs and speeding up time-to-market.

𝐆𝐞𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭:

Key Growth Drivers

Rising Demand for Digital Financial Solutions

The rapid adoption of digital financial services across various industries is one of the key drivers for the growth of the FaaS market. Businesses are increasingly seeking to enhance their customer offerings with digital wallets, payment gateways, and loan platforms, all powered by FaaS solutions that enable seamless integration with existing systems.

Shift to Cloud-Based Infrastructure

As businesses seek cost-effective and flexible solutions, the shift toward cloud computing is fueling the growth of FaaS. Cloud-based fintech solutions provide scalability, security, and easy integration, making it easier for financial institutions and other organizations to offer advanced financial products and services.

Regulatory Support and Compliance Requirements

Governments and regulatory bodies are creating frameworks that promote innovation in the financial sector while ensuring data protection and financial security. As a result, FaaS providers are evolving to meet compliance requirements, particularly in areas such as data security, anti-money laundering (AML), and know-your-customer (KYC) regulations.

Growing Investment in Financial Technology Startups

There has been a surge in venture capital funding for fintech startups, which are often utilizing FaaS platforms to build their businesses. The influx of investment is driving the demand for flexible and customizable financial services that FaaS platforms offer, propelling market growth.

Key Companies in the Fintech as a Service Market

- Finastra

- ThoughtWorks

- Visa Inc.

- Mastercard Incorporated

- Adyen N.V.

- Amazon Web Services, Inc.

- Stripe, Inc.

- Square, Inc.

- Marqeta, Inc.

- LendKey Technologies, Inc.

- Synapse Financial Technologies, Inc.

- Bankable

Recent Developments in the FaaS Industry

February 2023:

Stripe, Inc. introduced a new suite of financial products for businesses, including payment processing, lending, and fraud prevention, through its FaaS platform. These innovations provide businesses with a fully integrated solution to streamline their financial operations and offer better services to customers.

September 2022:

Finastra announced the launch of a new cloud-native banking platform that supports a wide range of financial services including payments, lending, and risk management. This platform leverages the power of FaaS to provide a more flexible, cost-efficient solution for banks and financial institutions globally.

Market Segmentation

The research study segments the FaaS market based on service type, deployment model, end-user, and region. This segmentation allows businesses to focus on key areas where there is the most opportunity for growth and aligns product offerings with customer needs.

FaaS Market, Service Type Outlook (Revenue – USD Billion, 2020-2034)

- Payment Solutions

- Lending Solutions

- Wealth Management

- Insurance Solutions

- Regulatory & Compliance Solutions

FaaS Market, Deployment Model Outlook (Revenue – USD Billion, 2020-2034)

- Cloud-Based FaaS

- On-Premise FaaS

FaaS Market, End-User Outlook (Revenue – USD Billion, 2020-2034)

- Banks

- Insurance Companies

- Investment Firms

- Retail & E-commerce Businesses

- Others

𝐂𝐥𝐢𝐜𝐤 𝐡𝐞𝐫𝐞 𝐭𝐨 𝐀𝐜𝐜𝐞𝐬𝐬 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭:

https://www.polarismarketresearch.com/industry-analysis/fintech-as-a-service-market

The Fintech as a Service (FaaS) market is set to experience impressive growth, driven by the increasing demand for digital financial services, cloud infrastructure adoption, and regulatory support. As more organizations look to enhance their financial offerings while reducing operational complexity, the FaaS market presents significant opportunities for growth. To stay ahead of the competition, companies must continue to innovate and provide scalable, secure, and customizable solutions that meet the diverse needs of their customers.

𝐌𝐨𝐫𝐞 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐋𝐚𝐭𝐞𝐬𝐭 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐁𝐲 𝐏𝐨𝐥𝐚𝐫𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Consumer Identity and Access Management (CIAM) Market

Open Radio Access Network (Open RAN) Market