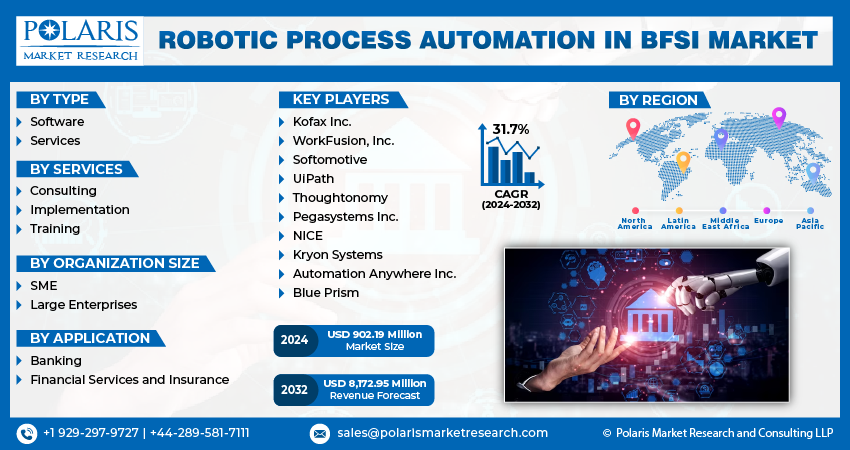

The Robotic Process Automation in BFSI (Banking, Financial Services, and Insurance) market is experiencing unprecedented growth, driven by rapid digital transformation and the need for operational efficiency. Valued at USD 814.35 million in 2023, the market is projected to expand at a robust compound annual growth rate (CAGR) of 31.70%, reaching USD 8,172.95 million by 2032.

Introduction to Robotic Process Automation in BFSI

RPA technology leverages software robots or “bots” to automate repetitive and rule-based tasks traditionally performed by humans. In the BFSI sector, RPA has proven instrumental in enhancing efficiency, reducing operational costs, improving accuracy, and enabling faster service delivery.

From automating customer onboarding and claims processing to regulatory compliance and fraud detection, RPA is transforming various aspects of banking, financial services, and insurance operations.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

https://www.polarismarketresearch.com/industry-analysis/robotic-process-automation-bfsi-market

Key Market Drivers

Several factors are fueling the adoption and growth of RPA in the BFSI market:

- Need for Operational Efficiency and Cost Savings

BFSI organizations face mounting pressure to reduce operational costs while maintaining high service standards. RPA provides a cost-effective solution by automating labor-intensive tasks, enabling institutions to achieve significant cost savings and improve efficiency.

- Rising Demand for Digital Transformation

The BFSI sector is undergoing rapid digital transformation to meet evolving customer expectations and stay competitive. RPA acts as a critical enabler of this transformation by automating legacy processes and integrating them with modern digital workflows.

- Regulatory Compliance and Risk Management

Adherence to complex regulatory requirements is a significant challenge for BFSI institutions. RPA ensures compliance by automating data collection, reporting, and monitoring tasks, minimizing the risk of errors and regulatory breaches.

- Improved Customer Experience

RPA allows BFSI organizations to deliver faster and more personalized services. Automated chatbots, for example, handle customer inquiries efficiently, while bots streamline loan approvals and account setup processes, enhancing customer satisfaction.

- Surge in Fraud Detection and Prevention Needs

The growing prevalence of cyber threats and financial fraud has prompted BFSI companies to adopt advanced technologies. RPA, combined with AI and machine learning, helps detect and prevent fraudulent activities by analyzing patterns and anomalies in real-time.

Key Applications of RPA in BFSI

RPA is being implemented across a wide range of applications in the BFSI sector, including:

- Customer Onboarding

- Automating KYC (Know Your Customer) processes.

- Extracting and validating customer data from various sources.

- Accelerating account opening and setup.

- Loan Processing

- Streamlining document verification.

- Automating credit risk assessment.

- Speeding up loan disbursement processes.

- Claims Management

- Automating claims intake and processing.

- Validating claims against policy terms.

- Enhancing the accuracy and efficiency of claims settlements.

- Regulatory Compliance

- Automating compliance reporting and monitoring.

- Ensuring adherence to Anti-Money Laundering (AML) and General Data Protection Regulation (GDPR) requirements.

- Fraud Detection

- Analyzing transactions for suspicious activities.

- Blocking fraudulent transactions in real-time.

- Back-Office Operations

- Automating data entry, payroll processing, and reconciliation tasks.

- Improving the speed and accuracy of financial reporting.

Emerging Trends in RPA Adoption

The RPA in BFSI market is witnessing several notable trends:

- Integration with AI and Machine Learning

The combination of RPA with AI and machine learning is enhancing bots’ capabilities to handle unstructured data, analyze patterns, and make intelligent decisions. This integration is transforming RPA from rule-based automation to intelligent process automation (IPA).

- Hyperautomation

Hyperautomation, which combines RPA with AI, analytics, and other advanced technologies, is gaining traction. This approach enables BFSI institutions to automate end-to-end processes, delivering superior efficiency and scalability.

- Cloud-Based RPA

Cloud-based RPA solutions are becoming increasingly popular, offering BFSI organizations flexibility, scalability, and cost savings. Cloud RPA also supports seamless integration with other cloud-based applications.

- Focus on Employee Empowerment

RPA is being used to relieve employees from mundane tasks, allowing them to focus on higher-value activities such as strategic planning and customer relationship management.

- Adoption of No-Code/Low-Code Platforms

No-code and low-code RPA platforms are enabling non-technical users to deploy automation solutions, democratizing RPA adoption across organizations.

Regional Insights

- North America

North America dominates the RPA in BFSI market due to the high adoption of digital technologies and the presence of leading financial institutions. The region’s regulatory landscape further drives the demand for RPA to ensure compliance.

- Europe

Europe is witnessing significant growth in RPA adoption, driven by stringent regulatory requirements such as GDPR and the growing need for operational efficiency.

- Asia-Pacific

The Asia-Pacific region is emerging as a high-growth market, fueled by the rapid expansion of the banking and insurance sectors, particularly in countries like India and China. The increasing focus on digital transformation in these markets is further accelerating RPA adoption.

- Latin America and Middle East & Africa

These regions are gradually adopting RPA as financial institutions seek to enhance efficiency and reduce operational costs in a competitive market.

Challenges in RPA Adoption

Despite its benefits, the adoption of RPA in BFSI faces some challenges:

- High Initial Investment

The deployment of RPA solutions can involve significant upfront costs, particularly for small and mid-sized organizations.

- Resistance to Change

Employees may resist the adoption of RPA due to concerns about job displacement or the complexity of integrating new technologies into existing workflows.

- Scalability Issues

Scaling RPA solutions across an organization can be challenging, especially in complex and dynamic environments.

- Cybersecurity Risks

The increasing use of RPA raises concerns about data security and the potential for cyberattacks. BFSI institutions must implement robust cybersecurity measures to protect sensitive data.

Future Outlook

The future of RPA in BFSI is highly promising, with advancements in AI, machine learning, and automation expected to unlock new opportunities. The market is likely to witness:

- Increased adoption of intelligent process automation (IPA).

- Greater focus on customer-centric solutions.

- Wider integration with emerging technologies like blockchain and IoT.

- Enhanced scalability and interoperability of RPA platforms.

As the BFSI sector continues to prioritize efficiency, agility, and innovation, RPA will play a pivotal role in shaping the industry’s future.

Conclusion

The Robotic Process Automation in BFSI market is on a rapid growth trajectory, driven by the demand for operational efficiency, digital transformation, and enhanced customer experiences. With a projected CAGR of 31.70% from 2024 to 2032, RPA is set to revolutionize banking, financial services, and insurance operations.

By leveraging RPA, BFSI institutions can achieve cost savings, streamline processes, ensure compliance, and deliver superior service to customers. As technology continues to evolve, the adoption of RPA will only accelerate, cementing its role as a cornerstone of the BFSI sector’s digital transformation journey.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐌𝐨𝐫𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Meditation Management Apps Market

Security Operations Center Market

Satellite Data Services Market

Team Collaboration Software Market