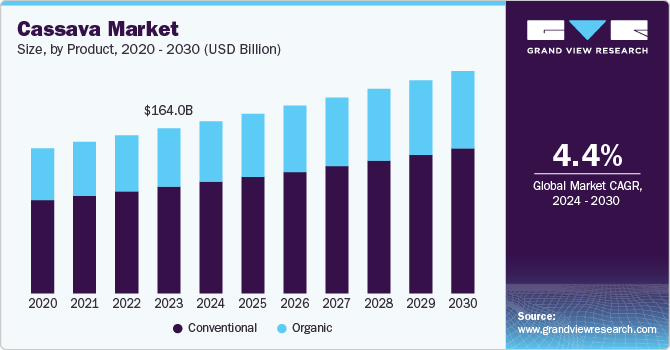

Cassava Market Size & Trends

The global cassava market size was estimated at USD 164 billion in 2023 and is expected to grow at a CAGR of 4.4% from 2024 to 2030. One of the primary reasons for this growth is the increasing demand for gluten-free products. With rising health consciousness among consumers, particularly in Western markets, cassava has gained recognition as a nutritious alternative to wheat and other gluten-containing grains. This trend is reflected in the growing popularity of cassava-based foods, such as flour, snacks, and noodles, which cater to individuals with gluten intolerance or those pursuing gluten-free diets.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/cassava-market-report

The cassava industry faces several challenges that hinder its growth and development, particularly in regions where it is a staple crop. One of the most significant issues is post-harvest losses. Cassava is a highly perishable crop; improper handling and storage can lead to substantial waste. In many producing countries, inadequate infrastructure for transportation and storage exacerbates this problem, resulting in a loss of both quantity and quality of the crop before it reaches consumers or processing facilities. This inefficiency affects food security and diminishes the income potential for farmers who rely on cassava as their primary source of livelihood.

Another challenge is the limited access to markets for smallholder farmers. Many cassava producers operate on subsistence and lack the resources to engage in larger, more profitable markets. Marketing cassava can be particularly difficult due to its bulky nature and perishability, which increase transportation costs. In addition, small-scale farmers often receive a lower share of the market price due to the lack of organized marketing channels and bargaining power, which prevents them from maximizing their profits.

Product Insights

Conventional cassava was the leading segment and accounted for a market value of USD 105 billion in 2023. The growth of the conventional cassava industry is primarily driven by its versatility and cost-effectiveness as a staple food source. With increasing urbanization and a growing global population, there is a rising demand for affordable and accessible food products. Conventional cassava, often produced on a larger scale using established agricultural practices, can meet this demand efficiently. Moreover, conventional cassava products, such as starch and flour, are widely used in various food applications, including snacks, baked goods, and sauces, further propelling market growth. The affordability and availability of conventional cassava make it an attractive option for consumers and manufacturers looking to capitalize on its culinary applications.

Type Insights

Cassava’s use as cassava flour is expected to grow at a CAGR of 4.50%. The rise in demand for gluten-free products is a primary factor driving this growth, as consumers seek alternatives to wheat flour due to health concerns related to gluten intolerance. Furthermore, cassava flour’s versatility in various culinary applications—from baking to thickening sauces—makes it a popular choice among health-conscious consumers and food manufacturers.

Application Insights

Food & beverage applications of cassava was valued at USD 70 billion in 2023. The food industry represents one of the largest applications for cassava, driven by the increasing demand for gluten-free and alternative starches. As health-conscious consumers seek natural and gluten-free options, cassava flour and starch have become substitutes for wheat flour in baking and cooking. The versatility of cassava allows it to be used in a wide range of food products, including snacks, sauces, and baked goods. Furthermore, the rise of plant-based diets and clean-label products has further fueled the demand for cassava-based ingredients in food manufacturing. This trend is expected to continue as more consumers prioritize health and wellness in their dietary choices.

Regional Insights

Asia Pacific cassava market accounted for over 55% of the global market in 2023. The market growth in Asia is primarily driven by increasing demand for cassava-based products across various sectors, including food, pharmaceuticals, and textiles. As consumers become more health-conscious and seek gluten-free options, cassava flour and starch have gained popularity as versatile alternatives to traditional ingredients. Innovations in processing technology have further enhanced the quality and functionality of cassava products, making them more appealing to manufacturers. Moreover, the rising trend of veganism and vegetarianism in the region has contributed to the growth of cassava as a key ingredient in plant-based diets, positioning it as a staple food source that meets evolving consumer preferences.

Key Cassava Company Insights

The key players are Grain Millers, Inc., Woodland Foods, Mhogo Foods Ltd., Otto’s Naturals, Venus Starch Industries, and Cargill. These companies leverage strategies such as product launches, acquisitions, and partnerships to enhance their market presence and adapt to changing consumer demands. Technological advancements also influence the competitive landscape, with many companies investing in research and development to improve processing efficiency and product quality. This focus on innovation is essential for maintaining competitiveness in a market that increasingly values health-conscious and natural food products.

Key Cassava Companies:

The following are the leading companies in the cassava market. These companies collectively hold the largest market share and dictate industry trends.

- Agrideco Vietnam Co., Ltd.

- American Key Food Products Inc.

- Archer Daniels Midland Company

- Cargill, Incorporated

- Grain Millers Inc.

- Ingredion Inc.

- Parchem Fine and Specialty Chemicals

- Psaltry International Ltd.

- Tate & Lyle Plc

- Venus Starch Suppliers

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/cassava-market-report