Global Stablecoins & CBDCs Market: Growth, Opportunities, and Key Players

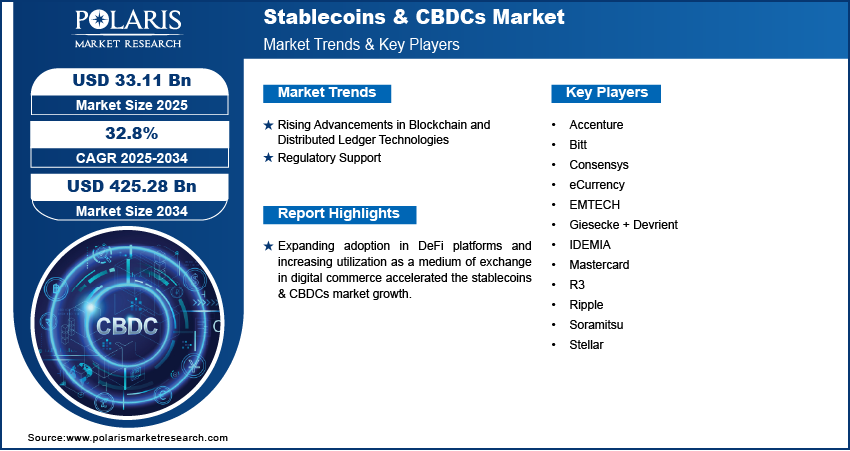

The global stablecoins and central bank digital currencies (CBDCs) market has been evolving rapidly, fueled by increasing demand for stable, digital financial systems. As of 2024, the market is valued at USD 25.20 billion, and it is expected to experience tremendous growth, reaching USD 33.11 billion in 2025 and an astounding USD 425.28 billion by 2034, registering a compound annual growth rate (CAGR) of 32.8% during the forecast period from 2025 to 2034. The surge in interest surrounding cryptocurrencies, blockchain technologies, and the increasing adoption of digital assets by governments and financial institutions is driving this market expansion.

Market Overview

Stablecoins, which are digital currencies pegged to a stable asset such as the US dollar or gold, have been gaining traction as a reliable and less volatile alternative to cryptocurrencies like Bitcoin and Ethereum. These digital assets provide a way to mitigate the price fluctuations commonly associated with cryptocurrencies, making them more attractive for real-world applications such as payments, remittances, and investment.

Meanwhile, Central Bank Digital Currencies (CBDCs) are digital currencies issued by central banks. They are backed by government authorities and serve as legal tender. Governments and central banks are keen on the development and implementation of CBDCs, recognizing their potential to modernize financial systems, reduce costs, and ensure greater transparency. Countries such as China, the European Union, and the United States have been testing and implementing pilot projects in this space, signaling the future of digital currency.

The market for stablecoins and CBDCs is becoming a significant part of the global digital finance ecosystem, and the increasing number of regulations and frameworks being introduced worldwide is set to enhance this further. By 2034, the market is expected to play a vital role in the mainstream adoption of digital financial systems.

Key Market Growth Drivers

-

Rising Demand for Digital Payments

The growing adoption of digital payments across the globe is one of the key drivers for the growth of the stablecoins and CBDCs market. As consumers and businesses move away from traditional banking, there is a shift towards digital and decentralized financial systems. Stablecoins offer an easy-to-use and secure method for making transactions, while CBDCs present a trusted, government-backed alternative to private cryptocurrencies. -

Government and Central Bank Initiatives

Governments are recognizing the advantages of digital currencies, which include financial inclusion, increased payment efficiency, and economic control. The People’s Bank of China (PBOC) has made significant strides in the development of the digital yuan, a CBDC that is already undergoing testing in multiple cities. Similarly, the European Central Bank and the U.S. Federal Reserve are actively exploring the potential of CBDCs, with numerous pilot projects underway. -

Enhanced Financial Security and Transparency

Blockchain technology, which underpins stablecoins and CBDCs, offers transparent, tamper-proof ledgers that help improve the security and integrity of financial systems. Stablecoins and CBDCs, by their very nature, provide a more secure means of transaction, reducing the potential for fraud and financial crimes. As regulatory frameworks surrounding digital currencies evolve, greater adoption by both institutions and consumers is anticipated. -

Volatility in Traditional Cryptocurrencies

The volatility inherent in traditional cryptocurrencies has created a market gap for more stable digital assets. Stablecoins, by being pegged to fiat currencies, offer a more reliable alternative, making them appealing for both investors and users in day-to-day transactions. CBDCs provide a similar benefit, offering stability backed by government support.

Stablecoins & CBDCs Market Segment Insights

Stablecoins & CBDCs Market Assessment by Type Outlook

The global stablecoins & CBDCs market segmentation, based on type, includes stablecoins and CBDCs. In 2024, the stablecoins segment accounted for the largest market share due to its extensive adoption in digital payments, decentralized finance (DeFi), and cross-border transactions. Their ability to provide price stability, backed by fiat reserves or algorithmic mechanisms, positioned them as a preferred choice for institutional and retail investors. Increased integration with payment processors and crypto exchanges further solidified stablecoins’ role in enhancing liquidity within digital asset ecosystems. The rise of tokenized assets and institutional-grade stablecoin solutions, backed by regulatory clarity in key markets, contributed to stablecoins & CBDCs market expansion, reinforcing their dominance across global financial applications.

The CBDCs segment is expected to register a higher CAGR over the forecast period due to central banks’ increasing initiatives to develop sovereign digital currencies. The adoption of CBDCs aims to enhance financial inclusion, reduce transaction costs, and improve monetary policy efficiency, contributing to stablecoins & CBDCs market demand. Governments across emerging and developed economies are accelerating pilot programs, leading to the integration of CBDCs into mainstream banking systems. Advancements in distributed ledger technology (DLT) and interoperability frameworks are further improving scalability, security, and real-time transaction processing, positioning CBDCs as a transformative force within global financial markets.

Browse Full Insights:

https://www.polarismarketresearch.com/industry-analysis/stablecoins-and-cbdcs-market

Regional Analysis

-

North America: The U.S. and Canada are seeing massive investments in blockchain and cryptocurrency technologies, which is spurring the demand for both stablecoins and CBDCs. Stablecoins are mainly used for cross-border transactions, as they provide a secure and low-cost alternative to traditional banking systems. The U.S. Federal Reserve’s exploration of a digital dollar is also fueling growth in the CBDC market.

-

Europe: Europe is actively exploring the integration of CBDCs, particularly the digital euro. The European Central Bank has indicated that it will proceed cautiously, ensuring that all aspects of digital currency design are aligned with Europe’s financial regulations and monetary policy. Stablecoins are already widely used in the region, particularly in the realm of decentralized finance (DeFi).

-

Asia-Pacific: Asia continues to lead the charge with blockchain and digital currency innovation, particularly in China, where the digital yuan is already in pilot testing. India, Japan, and South Korea are also making strides in their CBDC projects, with a strong emphasis on the benefits of digital currencies for financial inclusion.

-

Middle East and Africa: This region is expected to see growing interest in stablecoins for remittance payments. Countries like the UAE are already positioning themselves as leaders in blockchain development, and CBDC trials are gaining momentum in countries such as Saudi Arabia and Bahrain.

Key Companies

Several companies are playing a key role in the development of the stablecoins and CBDCs market. These include both established players in the financial sector and new fintech companies:

-

Tether: As the issuer of USDT, the most widely used stablecoin globally, Tether has established itself as a major player in the market.

-

Circle: The company behind USDC, another leading stablecoin, has partnerships with major financial institutions to facilitate fast and secure digital payments.

-

Paxos: Known for issuing the Paxos Standard (PAX) and working with major financial institutions, Paxos is driving stablecoin adoption across different sectors.

-

IBM: IBM’s blockchain platform, including its work on CBDC development, is helping governments and institutions design and implement digital currencies.

-

Ripple: Ripple, with its RippleNet payment system, is working to enable faster and cheaper cross-border payments using blockchain technology and stablecoins.

Conclusion

The stablecoins and CBDCs market is positioned for substantial growth, with increasing demand for digital payment systems, government initiatives, and advancements in blockchain technology driving this expansion. With a projected market value of USD 425.28 billion by 2034, this space will continue to revolutionize how transactions are conducted globally. Stakeholders, including financial institutions, governments, and technology companies, will need to collaborate to ensure that stablecoins and CBDCs can deliver on their promise of creating more secure, transparent, and efficient financial systems.

As this market evolves, key players will continue to innovate, shaping the future of finance. For investors, financial institutions, and consumers, the rise of stablecoins and CBDCs represents a unique opportunity to be part of a transformative era in the financial services industry.

More Trending Latest Reports By Polaris Market Research:

Customer Relationship Management Market

Aircraft Cabin Interiors Market

Plastic Injection Molding Machine Market

Location Based Advertising Market

Retinal Vein Occlusion (RVO) Market

The Growing Importance of Customer Experience Management Market