The automotive fuel cell market represents a crucial segment of the clean energy and sustainable mobility landscape. Fuel cells, particularly hydrogen fuel cells, are at the forefront of revolutionizing the automotive industry by providing an alternative to traditional gasoline and diesel engines. These clean technologies are poised to help reduce carbon emissions, improve energy efficiency, and create a more sustainable future for transportation.

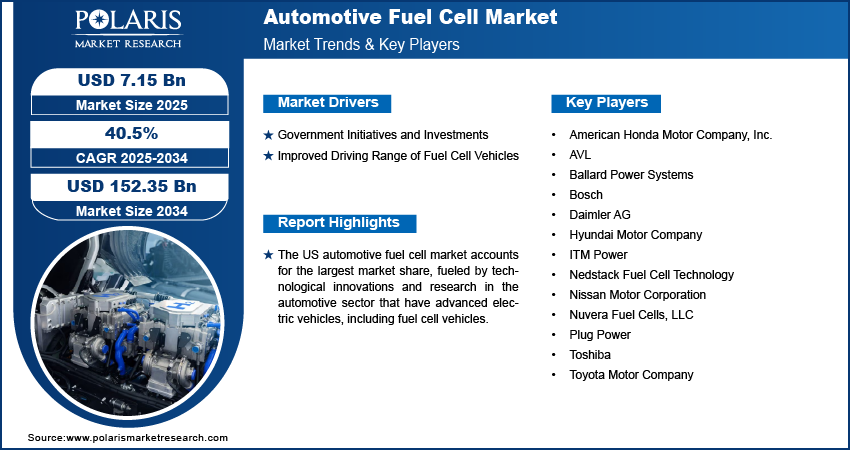

In 2024, the global automotive fuel cell market was valued at USD 5.10 billion. The market is set to grow at a rapid pace, projected to expand from USD 7.15 billion in 2025 to USD 152.35 billion by 2034, at an impressive Compound Annual Growth Rate (CAGR) of 40.5% during the forecast period (2025–2034). This remarkable growth is driven by technological advancements, government initiatives, and the increasing demand for eco-friendly alternatives to traditional internal combustion engine (ICE) vehicles.

Growth Drivers

Several pivotal factors are propelling the growth of the automotive fuel cell market, ranging from technological innovations to favorable government policies. The convergence of these elements is fostering the widespread adoption of fuel cell technology in vehicles.

- Rising Demand for Zero-Emission Vehicles

One of the primary drivers of the automotive fuel cell market is the global push toward zero-emission vehicles (ZEVs). As governments and corporations strive to meet stringent emissions targets and reduce their carbon footprint, fuel cell electric vehicles (FCEVs) are gaining prominence as a viable alternative to traditional gasoline and diesel-powered vehicles. Fuel cells produce electricity through a chemical reaction between hydrogen and oxygen, emitting only water vapor and heat as by-products—making them an ideal solution for reducing harmful emissions in the automotive sector.

International initiatives like the Paris Agreement have led many countries to set ambitious climate goals, with European Union, China, and Japan among the regions pushing for significant reductions in carbon emissions. This regulatory environment is accelerating the transition to hydrogen-powered vehicles, thereby driving market demand.

- Government Support and Incentives

Governments worldwide are increasingly offering financial incentives, subsidies, and tax breaks to promote the adoption of green technologies such as hydrogen fuel cells. These policies aim to create a favorable environment for the development, production, and adoption of FCEVs.

For example, countries like Germany, Japan, and South Korea have already implemented various initiatives to support the growth of fuel cell technologies. Japan’s Hydrogen Roadmap, which aims to make hydrogen a key part of the country’s energy future, is one such example. In addition, California in the United States is leading the charge in North America, offering incentives for hydrogen refueling infrastructure and fuel cell vehicle purchases.

These government incentives and policies are expected to drive significant growth in the automotive fuel cell market as they help offset the high initial costs of fuel cell vehicles and refueling infrastructure.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

https://www.polarismarketresearch.com/industry-analysis/automotive-fuel-cell-market

- Technological Advancements in Fuel Cell Efficiency

The automotive fuel cell industry has witnessed significant advancements in fuel cell efficiency over the last decade. Researchers and automakers are continually working to enhance the performance, durability, and efficiency of fuel cells. Improvements in hydrogen storage, fuel cell catalysts, and membrane technologies have led to higher energy densities and better performance.

Innovations such as solid oxide fuel cells (SOFC) and proton exchange membrane fuel cells (PEMFC) are improving fuel cell efficiency, increasing vehicle range, and making hydrogen-powered vehicles more practical for everyday use. Moreover, the development of lightweight materials and hydrogen storage systems is further improving fuel cell vehicle performance while reducing costs.

As fuel cell technology continues to evolve, it is expected to become more cost-competitive with conventional internal combustion engines, making fuel cell vehicles more accessible to a wider market.

- Hydrogen Infrastructure Development

The expansion of hydrogen refueling stations is another critical driver for the automotive fuel cell market. Hydrogen infrastructure has traditionally been a bottleneck in the widespread adoption of fuel cell vehicles. However, efforts to build a global hydrogen refueling network are gaining momentum, with investments from both public and private sectors.

Regions like Europe, North America, and Asia-Pacific are heavily investing in expanding hydrogen refueling stations, with companies like Toyota, Shell, and Air Liquide leading the way in infrastructure development. A robust refueling network will enhance the convenience and usability of fuel cell vehicles, further accelerating their adoption.

- Environmental Concerns and Clean Energy Transition

As awareness of environmental issues such as air pollution, climate change, and resource depletion grows, both consumers and businesses are seeking cleaner alternatives to fossil fuel-powered vehicles. Fuel cell vehicles offer a sustainable solution to these challenges, with hydrogen being the most abundant element in the universe and offering the potential for zero-emission mobility.

The growing interest in renewable energy sources such as wind and solar power also complements the rise of fuel cell technology, as green hydrogen can be produced through electrolysis using renewable energy sources. This eco-friendly synergy between renewable energy production and fuel cell technology is creating a sustainable future for the automotive sector.

Key Trends

The automotive fuel cell market is evolving rapidly, and several trends are shaping its future trajectory:

- Fuel Cell Integration in Commercial Vehicles

While the adoption of fuel cell technology in passenger vehicles is progressing, there is growing interest in fuel cell commercial vehicles, including buses, trucks, and logistics fleets. These heavy-duty vehicles require long-range capabilities, and hydrogen fuel cells provide an ideal solution with their high energy density and fast refueling time compared to battery electric vehicles (BEVs).

Hydrogen-powered trucks and buses are already being tested in various regions, with companies like Hyundai and Nikola leading the charge in commercial vehicle fuel cell development. These vehicles can play a crucial role in reducing emissions from the transportation of goods and people.

- Hybridization of Fuel Cell and Battery Electric Vehicles

To overcome some of the limitations of both fuel cell and battery electric vehicles, automakers are exploring the hybridization of these two technologies. The hybridization of fuel cell electric vehicles (FCEVs) with battery electric vehicles (BEVs) is expected to optimize the benefits of both technologies.

By integrating both hydrogen fuel cells and batteries, manufacturers can offer vehicles with increased range and efficiency, particularly in heavy-duty applications like long-haul trucks and commercial vehicles. This trend is expected to drive the growth of the automotive fuel cell market by offering a more flexible and efficient alternative to traditional vehicles.

- Strategic Partnerships and Collaborations

As the automotive fuel cell market grows, more companies are collaborating to accelerate the development and commercialization of fuel cell technology. Strategic partnerships between automakers, energy companies, and technology providers are becoming increasingly common.

For instance, companies like Toyota, Honda, and BMW are working together to improve hydrogen infrastructure and fuel cell vehicle technology. Similarly, energy companies such as Shell and TotalEnergies are partnering with automakers to develop refueling infrastructure and facilitate the widespread adoption of fuel cell vehicles.

Research Scope and Methodology

The research for this market analysis has been conducted through:

- Primary Research: Interviews with industry experts, fuel cell manufacturers, and automotive companies.

- Secondary Research: Extensive review of existing market reports, white papers, and industry publications.

- Quantitative Analysis: Use of statistical models to project market growth, including CAGR calculations and industry trend analysis.

The report covers the entire fuel cell value chain, from fuel cell production to vehicle manufacturing and hydrogen refueling infrastructure.

Market Segmentation

- By Fuel Cell Type

- Proton Exchange Membrane Fuel Cells (PEMFC)

- Solid Oxide Fuel Cells (SOFC)

- Alkaline Fuel Cells (AFC)

- Phosphoric Acid Fuel Cells (PAFC)

- Other Fuel Cell Types

Insight: PEMFC is expected to dominate the market due to its superior performance in automotive applications, especially in terms of energy efficiency and compactness.

- By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Buses

- Trucks

- Delivery Vehicles

- Others

Insight: The commercial vehicle segment is expected to experience significant growth as fuel cell technology offers substantial benefits for long-haul and heavy-duty transportation.

- By Application

- Light-Duty Vehicles (LDVs)

- Heavy-Duty Vehicles (HDVs)

- Public Transport

- Freight and Logistics

Insight: Heavy-duty vehicles and public transport are expected to see substantial growth due to the need for long-range and eco-friendly alternatives in these sectors.

- By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Insight: Asia-Pacific, particularly Japan, South Korea, and China, is expected to dominate the automotive fuel cell market due to the high adoption of fuel cell vehicles and strong government support for hydrogen infrastructure.

Automotive Fuel Cell Market Developments

January 2024: Hyundai Motor Company and Kia Corporation announced a strategic partnership focused on advancing polymer electrolyte membrane (PEM) technology for hydrogen fuel cell systems. This collaboration aims to lead the development of next-generation PEM technology for fuel cell electric commercial vehicles.

May 2023: Hyundai teamed up with Plus to showcase the XCIENT Fuel Cell truck, equipped with Plus’s Level 4 autonomous driving software, at the Advanced Clean Transportation (ACT) Expo in the U.S. This collaboration seeks to improve road safety and operational efficiencies in freight transportation.

August 2023: Ballard Power Systems joined forces with Ford Trucks to develop fuel cell-powered heavy-duty trucks. The partnership will deliver 2 FCmove™-XD 120 kW fuel cell engines to Ford Trucks, supporting the transition to zero-emission heavy-duty transportation.

Competitive Landscape

Key players in the automotive fuel cell market include:

- Toyota Motor Corporation

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- BMW AG

- Nikola Corporation

- Ballard Power Systems

- Plug Power

- Air Liquide

Strategic Initiatives:

- R&D investments in fuel cell technology and hydrogen production

- Collaborations with energy providers and other automakers to expand hydrogen infrastructure

- Partnerships with government agencies for infrastructure development

Conclusion

The global automotive fuel cell market is poised for exceptional growth, with a projected value of USD 152.35 billion by 2034 and a CAGR of 40.5% from 2025 to 2034. Fueled by technological advancements, government support, and increasing demand for clean and sustainable transportation, the automotive fuel cell market is set to play a pivotal role in the future of the automotive industry. With innovations in hydrogen storage, infrastructure development, and the rise of commercial vehicle adoption, the future of fuel cell technology is brighter than ever.

More Trending Latest Reports By Polaris Market Research:

Patient Referral Management Software Market

Automotive Ethernet Market: Making Vehicle-To-Vehicle Interaction Easy