In a world driven by speed, convenience, and evolving consumer lifestyles, Quick Service Restaurants (QSRs) have cemented their place as a cornerstone of the global food service industry. Characterized by their limited menu, fast preparation times, and standardized operations, QSRs have become a popular dining choice for urban populations, busy professionals, and budget-conscious consumers alike.

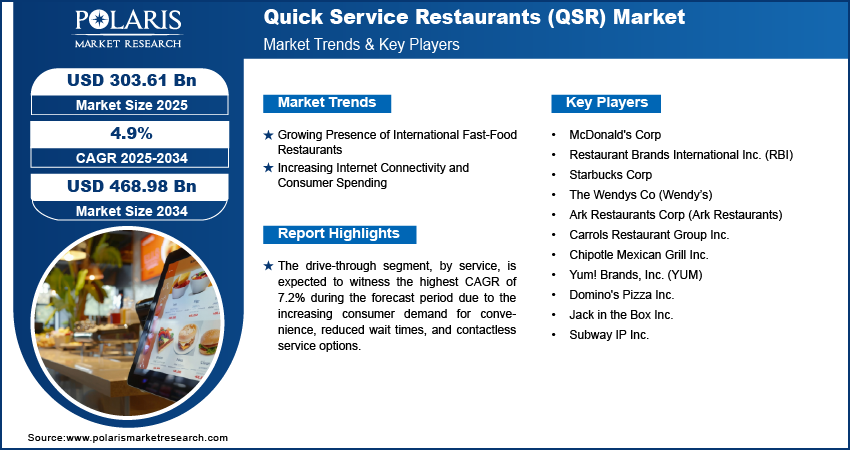

According to the latest findings by Polaris Market Research, the Quick Service Restaurants QSR Market was valued at USD 289.68 billion in 2024 and is projected to reach approximately USD 468.98 billion by 2034, expanding at a Compound Annual Growth Rate (CAGR) of 4.9% during the forecast period of 2025 to 2034. This sustained growth trajectory highlights the resilience and adaptability of the QSR industry amid evolving consumer expectations, economic shifts, and competitive pressures.

The market’s upward momentum is being driven by an amalgam of factors including increased urbanization, changing dietary habits, rising disposable incomes, digital transformation, and a growing appetite for global and ethnic cuisines—all under the umbrella of convenience and affordability.

Competitive Landscape

- McDonald’s Corp

- Restaurant Brands International Inc. (RBI)

- Starbucks Corp

- The Wendys Co (Wendy’s)

- Ark Restaurants Corp (Ark Restaurants)

- Carrols Restaurant Group Inc.

- Chipotle Mexican Grill Inc.

- Yum! Brands, Inc. (YUM)

- Domino’s Pizza Inc.

- Jack in the Box Inc.

- Subway IP Inc.

Market Growth Drivers

The robust growth of the QSR market is underpinned by multiple macroeconomic and behavioral drivers, making it a compelling sector for investors, entrepreneurs, and franchise operators:

- Urbanization and Changing Lifestyles

Rapid urban growth worldwide is fueling demand for fast and convenient food options. Urban dwellers often lead busier lives and seek quick meals during work breaks, commutes, or shopping trips. QSRs are strategically located in urban centers, transit hubs, and malls, meeting the needs of a mobile population.

- Technological Innovation and Digital Ordering

Digitalization has revolutionized the QSR landscape. Online ordering, mobile apps, self-service kiosks, and delivery platforms like Uber Eats, DoorDash, and Just Eat have enhanced customer convenience, reduced wait times, and expanded market reach. Loyalty programs, AI-powered recommendations, and data analytics are helping brands personalize the customer experience.

- Rising Disposable Incomes and Middle-Class Expansion

In emerging markets, a growing middle class is increasingly spending on out-of-home dining. QSRs, with their value-for-money positioning, benefit from this trend, especially among younger consumers and families seeking affordable indulgences.

- Globalization of Food Brands

Major QSR brands such as McDonald’s, Subway, Starbucks, KFC, and Domino’s continue to expand aggressively into new markets, bringing Western fast-food culture to Asia, Latin America, the Middle East, and Africa. This globalization drives market saturation in mature economies while opening new growth frontiers.

- Health-Conscious Fast Food Options

Consumers are demanding healthier, fresher, and more transparent food options—even in the fast-food segment. QSR chains are responding with expanded menus featuring salads, low-calorie items, plant-based proteins, and allergen-free products, attracting health-conscious diners.

- Rise of Cloud Kitchens and Delivery-Only Outlets

The proliferation of ghost kitchens—commercial kitchens designed solely for fulfilling online orders—is reshaping the economics of the QSR industry. These delivery-only models lower overhead costs, reduce real estate dependency, and allow brands to scale rapidly with minimal physical infrastructure.

Key Market Trends

Several evolving trends are shaping the present and future of the QSR industry. These trends are driven by consumer behavior, technology, and a competitive need for innovation:

- Customization and Menu Personalization

Today’s consumers want more control over their food choices. QSRs are increasingly offering customizable meals, allowing customers to select ingredients, toppings, and portion sizes. Build-your-own concepts, such as those in Chipotle or Subway, are thriving.

- Plant-Based and Alternative Proteins

Fueled by environmental concerns and dietary preferences, plant-based food items have made their way into mainstream QSR menus. Brands are partnering with companies like Beyond Meat and Impossible Foods to offer meat alternatives without compromising on taste.

- Sustainable and Eco-Friendly Practices

Environmental sustainability is becoming a competitive differentiator. QSRs are adopting eco-friendly packaging, reducing food waste, sourcing ethically produced ingredients, and cutting carbon emissions to meet both regulatory demands and consumer expectations.

- AI, Automation, and Robotics

From robot chefs and burger-flipping machines to AI-enabled drive-thrus and predictive inventory management, technology is streamlining operations, reducing costs, and improving service speed and accuracy. Automation is also helping QSRs address labor shortages.

- Localization of Menu Offerings

QSR brands are increasingly adapting their menus to local tastes and dietary preferences. This localization helps improve customer satisfaction and brand relevance across diverse cultural and regional markets.

- Mobile and Contactless Payment Systems

Digital wallets, NFC payments, and QR-code ordering systems are enhancing speed and safety, especially in the post-COVID world. Integration with loyalty programs also helps drive repeat purchases and customer retention.

Research Scope

The Polaris Market Research report offers a deep and multidimensional analysis of the QSR industry, including:

- Historical market performance (2020–2024) and forecast trends (2025–2034)

- Analysis of key product categories, service models, and consumer behavior patterns

- Evaluation of technological advancements, operational models, and supply chain dynamics

- Regional insights into performance drivers and challenges

- Comprehensive profiles of leading and emerging players

- In-depth examination of franchising models, expansion strategies, and market entry challenges

The report serves as a strategic tool for investors, franchisors, operators, and suppliers seeking to capitalize on this expanding market.

Market Segmentation

Quick Service Restaurants (QSR) Market Assessment by Type

5.1 Introduction

5.2 Independent

5.3 Chain

Quick Service Restaurants (QSR) Market Assessment By Cuisine

6.1 Introduction

6.2 American

6.3 Chinese

6.4 Italian

6.5 Mexican

6.6 Japanese

6.7 Turkish & Lebanese

6.8 Others

Quick Service Restaurants (QSR) Market Assessment By Service

7.1 Introduction

7.2 Eat-in

7.3 Takeaway

7.4 Drive-through

7.5 Home Delivery

By Geography

- North America: The most mature QSR market globally, characterized by brand saturation and intense competition.

- Europe: Steady growth with increasing demand for healthier fast food and local adaptations.

- Asia-Pacific: The fastest-growing region, driven by rising urban populations, digital adoption, and Westernization of eating habits. Key markets include China, India, Japan, and Southeast Asia.

- Latin America and Middle East & Africa (MEA): Emerging markets with untapped growth potential, fueled by economic development and franchise expansion.

Explore The Complete Comprehensive Report Here:

https://www.polarismarketresearch.com/industry-analysis/quick-service-restaurants-qsr-market

Quick Service Restaurants Market Developments

In November 2024, McDonald’s unveiled its new McValue platform, set to roll out across U.S. locations beginning January 2025. The initiative features a range of value-focused promotions, including the $5 Meal Deal, exclusive in-app offers, and regional discounts. A standout element is the “Buy One, Add One for $1” deal on select menu items, available throughout the day. This platform is designed to provide customers with greater convenience, affordability, and menu variety.

In July 2022, Chipotle launched a $50 million venture fund aimed at addressing key challenges within the restaurant industry. Following its initial investment in self-driving robotics firm Nuro, the company is now piloting “Chippy,” a robotic tortilla chip maker that streamlines production and reduces labor costs.

In June 2022, Subway announced a revamp of its catering services as part of a broader effort to expand beyond individual meal sales. With nearly 40,000 restaurants globally, the brand has redesigned its catering program for greater ease of use and launched its offerings on the ezCater marketplace, a corporate food solutions platform.

Conclusion

The Quick Service Restaurant (QSR) market stands at a dynamic intersection of food, technology, and lifestyle. Its resilience and consistent growth reflect the sector’s adaptability to shifting consumer preferences, economic environments, and technological landscapes.

The coming decade promises continued innovation and disruption—whether through AI-powered drive-thrus, lab-grown meat, drone deliveries, or hyper-personalized dining experiences. For stakeholders across the value chain, from franchisees to investors and suppliers, the opportunities are immense.

As consumer demand for convenient, affordable, and sustainable food options continues to rise, QSRs will play an increasingly important role in shaping the global foodservice ecosystem.

More Trending Latest Reports By Polaris Market Research: